12/27/2020 Plan:

This week, we take a look at Facebook (Ticker: FB) and a couple bullish put spread options. We also look at a play on General Motors (Ticker: GM)

12/27/2020 Plan (continued):

- FB – Sell January 15th 245/240 put spread for 0.55 OR

- FB – Sell January 15th 250/245 put spread for 0.82

- GM – Sell Jan 22nd 37.5 put for 0.47 OR

- GM – Sell Jan 22nd 37.5/35 put spread for 0.28

- Prices are as of market close 12/24/2020, actual fill and strikes may differ depending on Monday’s open, post will be updated accordingly.

- All trades are for educational purposes and do not constitute advice

12/27/2020 Commentary:

Facebook has spent most of December declining. This week’s trade assumes it will stop dropping by mid January – or at least that it won’t drop another $15-20.

Personally, I’ll be looking to place the 245/240, but understand some prefer a bit more premium and are willing to accept the higher risk. The 250/245 has a higher reward accordingly. Depending on how the market opens tomorrow, I may also go with the 250/245. I will also consider going one week further, to the 22nd. The 29th contains earnings, and we’ll avoid that expiration.

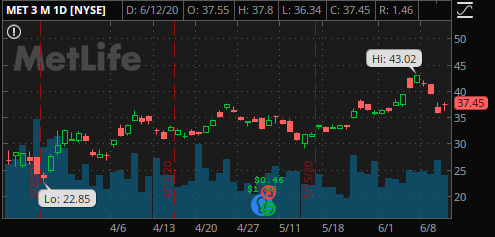

If you would like to own GM for a longer term play (dividend, investing heavily in electric, etc.), the 37.5 put expiring on January 22nd for 0.47 is a nice play. If you would prefer it as a trade, then pair it with a long 25 put and you will still take in a credit of 0.28 and cap your downside.

Reach out with any questions on this or any other trade!

12/28/2020 Entry:

Sold the Jan 22 250/245 put spread for 0.62. FB was up about $5 at the time of the trade, causing us to go out another week.

GM puts could still be sold for about 0.33, I’m personally passing and will enter if there is a dip later this week.

1/4/2021 Update:

Over the weekend, the market is showing this spread as worth 0.41, we have decayed about 1/3 of the initial premium in the first week. No change to the position management at this time.

1/10/2021 Update:

FB declined this week, but our put spread is still profitable. With expiration next week, we can take the position off for a small win and re-allocate capital or we can see how the week progresses and try to capture a bit more premium. I’ll be doing the latter, personally.

1/17/2021 Update:

The FB put spread expires this week and we are just out of the money. Gamma will be high. We have a few options – if FB goes up, we’ll be profitable and can close it. If it drops, we can close for a loss or roll it out to a future week. Another option for those with the cash, is to take assignment and sell calls against it. If it stays above 245 but below 250, I may take this route. This requires 25k of capital. Please note that earnings are coming up and so this will be a volatile play for one’s account. If there is an opportunity to close for a profit, that is the easier path.

1/24/2021 Close:

The FB Put spreads expired worthless this past week, bringing in 0.62/spread. FB had a nice move up and by the end of the week our spreads were pretty safely OTM.

Reach out with any questions on this or any other trade!