This week, let’s take a look at one way to try and buy the popular Russell 2000 ETF, IWM, for 10% off its current levels. As a bonus, we’ll get paid to do so. First let’s take a look at the chart over the last 6 months: You can see […]

Trade-Ideas

Implied Volatility is fun. Really. I have mentioned before that I think beginning option traders focus on delta, then find out about theta (after long calls expire worthless) and start selling options, and then more advanced traders learn about volatility and incorporate it and all the Greeks (Ok, not Rho) […]

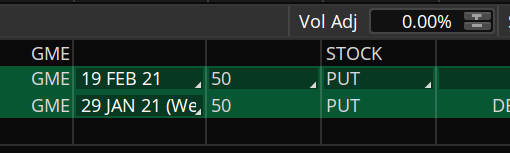

Let me start by saying I spent a LOT of time in EB Games (for the snootier game player – Electronics “Boutique”) and Babbage’s as a wee lad. I’ve liked video games since I was exposed to the Atari 2600. The NES practically changed my world – it definitely added […]

2020 Year End Results – as many people are trying to quickly get past 2020, I’ll keep this as brief as possible (for me). 2020 Year End Results At Option Salary we provide real results, shared publicly with everyone here. Members have access to to the trades before they are […]

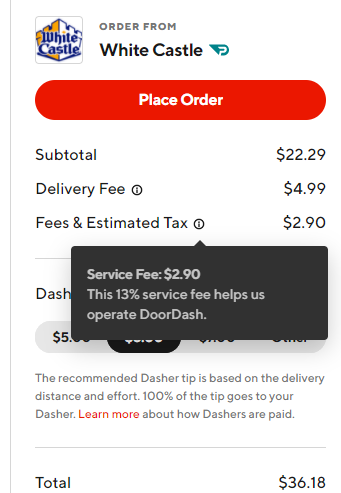

I’m bearish on DoorDash. I’ve been a user since before COVID, but really only when they offer a great deal – no delivery fee, $10 off, etc. During COVID, our family has used the service a bit more – but again, with promotions. They even offered a bonus $10 gift […]

Not too long ago, in addition to a poor joke or two, I suggested bullish option trades in Intel (Ticker: INTC) after it beat earnings and promptly sold off (a lot) on concerns over its struggles with 7 nm production. Flash forward one earnings cycle and the story is the […]

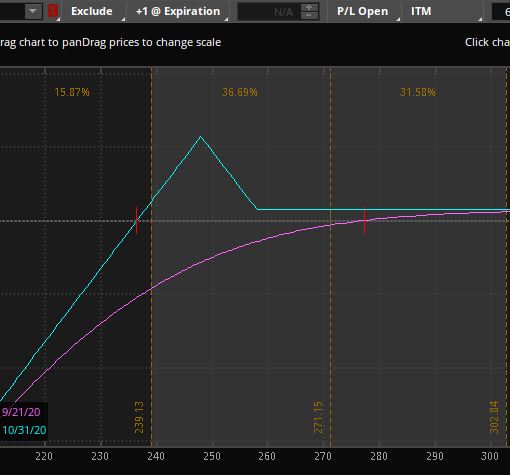

QQQ has returned over 28% this year (as of 9/25/2020). Just a few weeks ago, it was even higher topping 300. Made up primarily of “tech names”, it is well ahead of the other index-based ETFs as investors and traders bid up names that have done well in a pandemic. […]

I received a call from a member, a week before Apple’s split 4:1 asking whether they should buy shares for their long term account before the split or after the split. I gave my canned stock split pitch about how the value of the company is the same before and […]

Betcha can’t eat just one. No really, don’t eat Intel’s chips. They are terrible. Worse than this joke. Back on July 23rd, Intel reported earnings. They beat Wall Street’s estimate by $0.12 ($1.23 vs. $1.11). They beat on revenue as well ($19.7B vs $18.55B). Earnings, revenue, net income, etc. all […]

The Russell 2000 has lagged behind the S&P 500 and Well behind the Nasdaq 100 (pretty much everyone is lagging behind the QQQs…). This past week IWM (iShares Russell 2000 ETF) hit its highest levels since February. I had taken the opportunity to sell a call at the 156 level […]