I’m bearish on DoorDash. I’ve been a user since before COVID, but really only when they offer a great deal – no delivery fee, $10 off, etc. During COVID, our family has used the service a bit more – but again, with promotions. They even offered a bonus $10 gift card when you bought a $75 one – even if you bought it for yourself. That combined with the free delivery options made it cheaper than picking up the food ourselves.

First a Chart…

Normally I’d start an article off with a 6 month or 1 year chart, but DoorDash (Ticker: DASH) just went public last week. It closed at 189.51 after reaching a high of 195.5 on its first day of trading. It closed today (12/17/2020) at 154.21, already off $35 from its first day close. I think it has a lot further to go.

Bullish On DoorDash

Why would DoorDash be a good company to invest in? Well, the longer COVID lingers on, the more likely people are to want to order food and have it delivered. DASH also has approximately 50% off the food delivery business, so it is the largest player in the space. Uber Eats at number 2 has about half the share (I’ve written previously on my lack of confidence in Uber Eats and that extends to DoorDash). They are growing Fast and people love to pay for growth. Revenue through September was 1.92 Billion, up more than 2x compared to the same period in 2019 (Source DoorDash’s S1). They even squeaked a profit of $23M in Q2 (June 2020)!

Bearish On DoorDash

They were profitable in Q2! During, quite literally, the peak of a global pandemic the likes of which we haven’t seen for 100 years (despite my age, I missed the last one). Their S1, right after touting the profit is quick to mention they haven’t been profitable for a year since their founding.

Simply, from a fundamental perspective, they aren’t a solid business. Their market cap is almost $50B. As a point of reference that is bigger than Darden Restaurants (Olive Garden, LongHorn Steakhouse, The Capital Grille, and more). Oh and throw in Yum Brands, too (KFC, Pizza Hut, Taco Bell, and more).

Brand Loyalty

I could not care less which app delivers my food, do you? DoorDash, Uber Eats, GrubHub, Instacart, or the restaurant itself. I want the food delivered by whichever company the restaurant uses. If it uses more than one, I’m probably taking the cheaper option. My loyalty is to the Restaurant itself, not the delivery company. That means they’ll always be competing on price. In a race to the bottom, generally no one wins.

Turning a profit?

There is an old joke that while a business may lose money on every transaction, they make up for it in volume. With the exception of Q2, that has been the case for DoorDash – well, the losing money part. What levers do they have?

- Increase the fee to the restaurant. Restaurants are charged a commission in the neighborhood of 25-30%. Oof. In a historically low margin business, I can’t imagine restaurants accepting that much more. This is also an area where other competitors can come in with a lower price

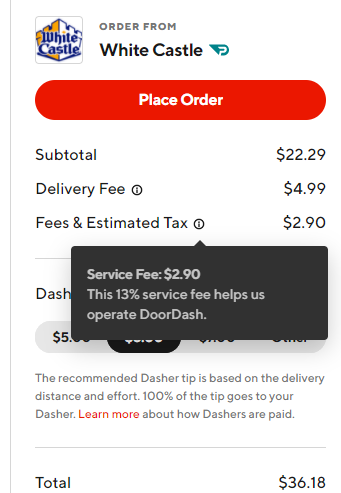

- Raise the delivery fee, surcharge, bonus fee, undercoating, etc. Let’s say I’m really fiending for some White Castle (no jokes please, Harold). Right now, I can get pick up a Sliders clutch – 20 tiny sliders, please – and the mandatory 20 pc Chicken Rings for only 22.29! These will be delivered to me in the next 44- 54 minutes for only $36.18. Wait. What? There is a $4.99 delivery fee. Plus the Fees & Estimated Tax – which to be clear, is just another 13% fee from DoorDash (picture below). Then a recommended $6 tip, the only thing we really know is going to the person actually doing the delivery. In other words, there are a lot of extra charges already built in. And I can drive to a White Castle, pick it up, and be enjoying it (maybe) in less time and for less money, even factoring in gas.

- Leverage the Flywheel. The S1 uses a great Private Equity concept, the “Flywheel. Basically once they gain some growth/momentum with one part, it feeds and grows the next part, which in turn feeds the original bit. Let’s look at a picture:

A fine concept, but my (small sample size) discussion with restaurant owners is they aren’t happy with the costs, I don’t want to pay full price, and the dashers are only making less than $2/hour according to some studies.

Restaurants are better

For a period of this summer, when case counts were lower, and the weather was nicer, we Loved going to restaurants (Outdoors, with masks, socially distanced). It was terrific to get out of the house and enjoy a nice meal. We don’t go out a ton, but it is a nice treat. We supported our favorite local restaurants, celebrated birthdays, and chatted with our favorite staff and owners to check in on them.

When things weren’t as good, we still supported our favorite restaurants and had the food delivered – and I appreciate DoorDash and their Dashers for providing this service.

But let’s face it. The experience is not as good. The food is definitely not as good. The food is always a little too cool, certain foods don’t travel as well [To the future inventor of a device that transports restaurant french fries and keeps them hot and crispy, thank you]. Then there are the occasional mistakes that can’t Really be corrected with food delivery. You explain to my small child why despite us having paid $9 for kids mac and cheese she has a kids steak. First world problems, I know and I’m getting off track. The point is, if I’m choosing between being waited on, getting out of the house, having better food and paying less -or- having lukewarm food and paying more, the decision is clear.

Demand Will drop when we get past the pandemic. And we will.

So let’s short the stock!

Woah. Slow down there. Don’t. There is a 25% chance I am WAY off and this won’t age well. DoorDash will be delivering Everything in the future from food, to Amazon packages, to newspapers and bottles of milk. They’ll be HUGE. And I’ll look foolish. And those that short stock will get crushed like TSLA short sellers (sorry).

So what options do we have?

Buy Puts

You can always buy a put and profit if the stock (continues to..) moves down. The main issue is that a put is quite expensive. I’m not the only one bearish and IV is high. A 1 month ATM put (155 strike) in January is currently trading for 16.85 at the midpoint. At expiration, the stock would need to be below 138.15 before you were profitable. Note that if the stock moves down sharply soon, it would still likely be profitable before expiration. The option will decay pretty quickly, currently 0.25/day ($25), increasing as we get closer to mid January.

Buy a Put Spread

Let’s say we think DASH will drop and we set a target of 120. We could then sell a 120 put to go with our 155 put. The 120 put currently trades for 4.25, reducing our outlay to 12.60. Now if at expiration DASH does end Right at 120, we’ll make $22.40 or $2240 on each put spread. Compare this to the $1815 we’d make buying just the $155 put (again assuming a $120 price at expiration).

Sell a Call Spread

Perhaps we are less confident that DASH will continue to drop and just believe it won’t rocket back up in the near term. We could sell an OTM call spread. If we don’t think it will go above its first day close, we could sell the January 190/200 call spread for 1.30. This would provide about a 15% return on our money if it expires worthless. That’s also $35 out of the money so you could sell a lower spread and increase the premium a bit (and also decrease the probability it expires out of the money

Put on a Poor Man’s Covered Put (ok, a diagonal)

Popular forums refer to buying a Long term call and selling shorter term calls as a “Poor Man’s Covered Call”. This is a similar idea only with puts.

Buy a Longer term put – say January 2022. Then sell a much nearer term put against it January 2021, for example. There are a lot of options (sorry) on how you can set this up to trade off the premium outlay along with how confident you are in a drop/price target and so on. As an example, we’ll simply buy an ATM put in January 2022 for 48.45 (155 Strike). Note the IV is 73.54). We can then sell a January 2021 OTM put and pull in some premium. You can select this strike to balance the premium received but also with your price target for January. We’ll reuse the 120 target from earlier and take in a credit of Let’s select the 105 strike for 4.25 for a net outlay of 44.20.

Note we have two different expirations and will need to manage it, especially as we reach January 2021 expiration. What can happen?

- Stock takes off. We lose. Our loss on the long put will be offset some by the short put we wrote.

- Stock REALLY plummets. Below the 87-89 level, depending on when this occurs, we’ll also start to lose because the position will start to act more and more like a 155/120 put spread – which we’ve paid $44.20 for and can only be worth $35

- Stock falls somewhere between $155 and that $87-$89 level. We win

Note if the stock is below 120, we’ll need to either close the whole position or buy back the short call and re-assess.

If the stock is in our profit zone and above 120, the short call will expire worthless and we’ll be left with a long put. We can now take off the long put and enjoy our profit -or-

Sell another put at a future expiration and repeat the process all over again.

TL;DR – Bearish on DoorDash

IPOs are crazy, I’m bearish on DoorDash, it is overvalued (Fingers crossed I’m not haunted by this in 10 years), but don’t short it. Find a smarter, risk defined way with Options.

Hope you enjoyed this long article about one of my top five favorite food delivery companies. I still miss HomeRuns grocery delivery back in my Boston days. It was So convenient and So cheap. Oh, they went out of business….

If you want to support more great free content from our site and somehow HAVEN’T used DoorDash, check them out. I will get $10 worth of soggy, not crisp French Fries and a kid’s steak. You’ll get $10 off your first three orders. Together we’ll help these bearish plays work out!

You can also check out our free and paid membership options. Or reach out to us via email, Facebook, or Twitter with any questions, article requests, or just to say hi!