Here we are again for round #3 of errors in The Striking Price, a weekly column in Barron’s. We have 2 errors to discuss in this one – an article about a very volatile stock, Tesla (Symbol: TSLA).

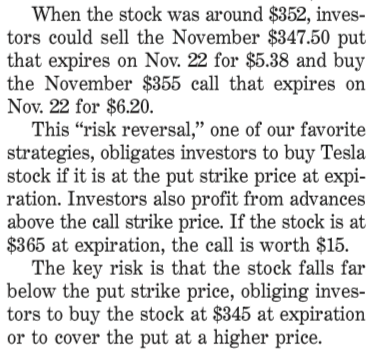

Do you see the issues?

Issue #1 – “If the stock is $365 at expiration, the call is worth $15”

Simply, with a $355 strike, if the stock is at $365, it is worth $10 at expiration. This is Options 101 – at expiration, if the stock is above a call’s strike price, the value is the stock price minus the strike price.

Issue #2 – “The key risk is that the stock falls far below the put strike price, obliging investors to buy the stock at $345…”

We are short the $347.5 put in the trade Steven describes, which means if TSLA is below $347.50 at expiration, we have to buy the stock at …. wait for it… $347.50. This is an elementary mistake and I fear that the editing has become even sloppier at Barron’s.

These are the obvious errors, it should be noted as well that if the stock does fall below the put price, the investor is also out the additional premium Paid for the risk reversal. Specifically $6.20 – $5.38 or $0.82.

Bonus lessons – Steven is clear that this is for “Aggressive investors with an appetite for risk”. He is right – to clarify, your risk is Not just the $0.82 initial outlay. You have all the downside risk of the stock below the short put at expiration.

Need to learn more about options basics? A great textbook style tome is recommended below and is a great way to show your support of free content on Option Salary. I have only read the first edition – the reviews on the second imply numerous errors.