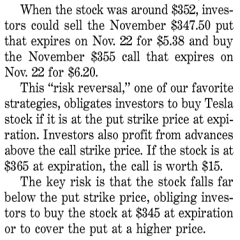

This is the fifth in an series of pointing out faulty options education, primarily in Barron’s. I’ve passed on a few in the last couple months, but these basic errors need a bit of public shaming with the hope that editorial quality will improve. What happened this time? The November […]

risk-reversal

4 posts

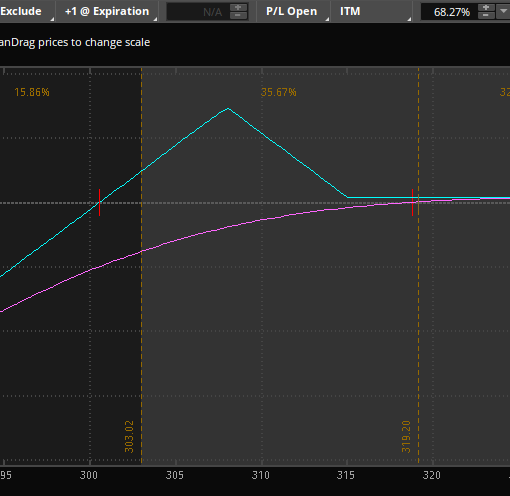

In case you missed it, the market shot up almost 5% last week. With this big move, I had some shares of SPY called away on Friday (short call against long stock). This week we discuss a few ways to get right back into the market to position ourselves to […]

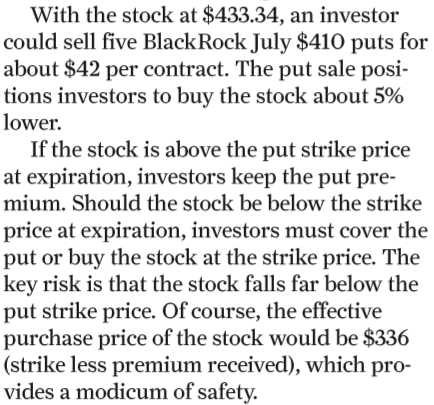

This is the fourth in an unexpected series of pointing out glaring errors in Barron’s. For some reason, the editorial quality has dropped off recently, leading to some pretty basic math errors being made and leading to confusion for new option traders. The 3/3/2020 recommends selling puts on BlackRock. A […]