This is the fourth in an unexpected series of pointing out glaring errors in Barron’s. For some reason, the editorial quality has dropped off recently, leading to some pretty basic math errors being made and leading to confusion for new option traders.

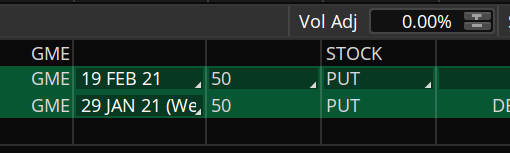

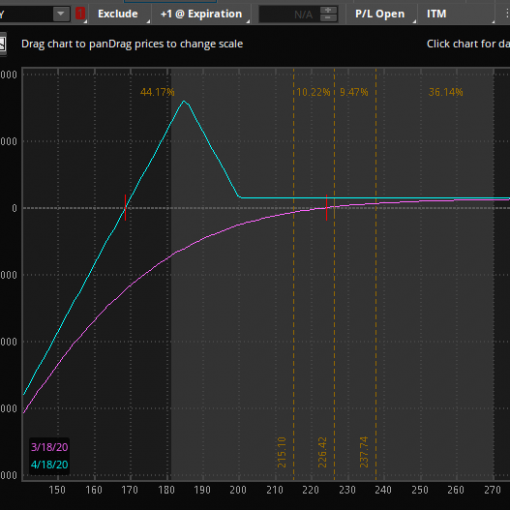

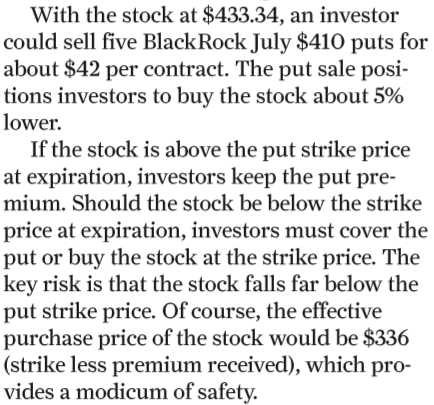

The 3/3/2020 recommends selling puts on BlackRock. A clip from the article is below. Do you see the error?

The trade idea is to sell a $410 July put for $42 per contract. If one is assigned, the article states the effective purchase price would be $336. Not even close. What is even more concerning is that Steven Sears correctly puts the formula in the text “strike less premium received” and then both he and the editors failed to find the fundamental math error.

The correct calculation is $410 – $42 = $368. If someone followed the article’s advice, their cost basis would differ from the article’s incorrect value by $4200!

I subscribe to Barron’s and generally find the content to be pretty good. The lack of attention to detail in their options content, however, is disappointing and can mislead investors that are new to options. A strong foundation is important to trade options – an even deeper understanding can be gained by studying a textbook like the one below:

If you are ready to learn to trade options profitably part time – join Option Salary for more free content today!