Implied Volatility is fun. Really. I have mentioned before that I think beginning option traders focus on delta, then find out about theta (after long calls expire worthless) and start selling options, and then more advanced traders learn about volatility and incorporate it and all the Greeks (Ok, not Rho) in their trades.

One fun thing about implied volatility is that you can be completely right on other Greeks yet still lose on a position because of changes in volatility. Let’s look at a recent couple of trades we took in Rocket Companies, Inc (Ticker: RKT) and see how the change in vol completely overwhelmed our position.

The Trade

On Monday March 1st, with RKT trading near 22.75, we

- Sold the April 1st 19 PUT for 0.30. IV was at 81%

Short puts are long delta, short gamma, long theta, and short vega (again, ignoring Rho…)

Implied Volatility is Fun…

… just look what happened the next day:

RKT took off like a … um … well… Rocket. My put sales (unfortunately with no call kickers) make me look like a genius! I struggle to think about how to spend all the money. Except…

The position is down. Quite a bit.

WHAT?!

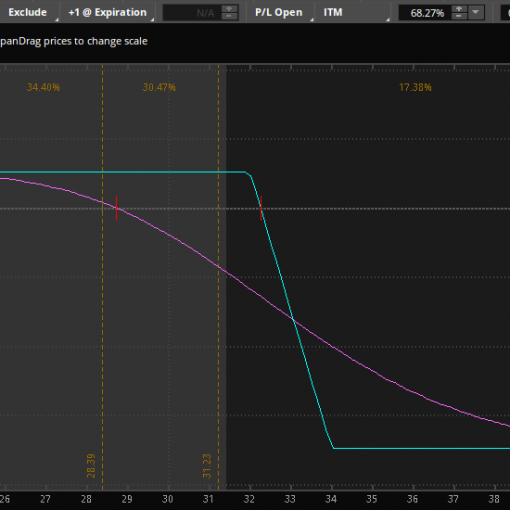

But the stock went up, that’s what we want it to do when we sell puts! True, but look what else happened. Implied volatility Really took off as well. From 81% to 166% around 2:30 PM on Tuesday. Remember we said we were Short Vega on this trade and that greatly overshadowed everything else.

Implied Volatility is (still) fun

The stock moved in our direction and IV took off and we’re losing on the position. I still liked RKT below 20 and so I sold More puts:

- Sold the Apr 1 18 puts for 0.43 at 166% IV. Stock at ~37.85

That’s right, the stock went up 66% and I sold puts at a Lower strike for More money. And that’s what IV is awesome.

Later that week…

RKT came back down to earth (last one, I promise!) later in the week and volatility also came in. The result to our position, despite the stock going Down? We were up money on both positions…

TL;DR – Implied Volatility is fun

Many treat options as leveraged substitutes for stock, focusing solely on Delta. To be profitable long term, one needs to understand how all of the Greeks (still not Rho… yet) and volatility impacts your positions and portfolio. This also allows the trader to find and implement opportunities that are not solely directional in nature.

Feel free to check out our free and paid membership options. Or reach out to us via email, Facebook, or Twitter with any questions, article requests, or just to say hi!