Let’s discuss a way to generate a bit of income on our long term stock holdings. This is a slight twist on the traditional covered call approach that I’ll be implementing on one of my underlyings in my long term portfolio.

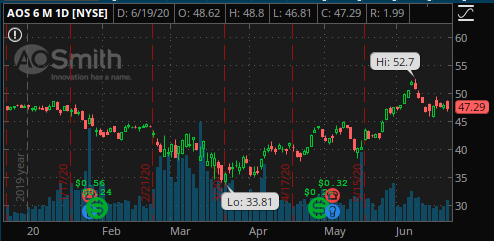

On Friday June 19th, I had some of my shares of A.O. Smith (Ticker: AOS) called away at the 45 strike.

AOS is a member of the Dividend Aristocrats club (not an official “club” with a secret handshake or anything). This means it has raised its dividend for at least 25 years in a row. I have a several of these companies in a long term account that steadily throws off increasing amounts of cash. Currently, I re-invest those dividends, but when I retire, I’ll use the dividends as an additional source of income.

Now that I’m out of some shares and have spare cash in my account, I’ll look to get back in – at a discount. I still have shares in my account and wouldn’t mind selling some more – at a premium. Let’s look at a trade that lets me do both:

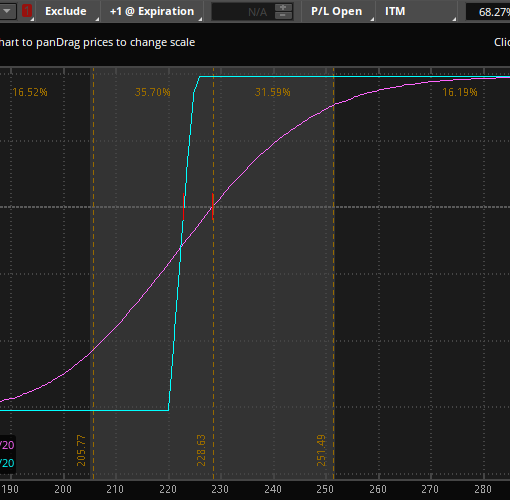

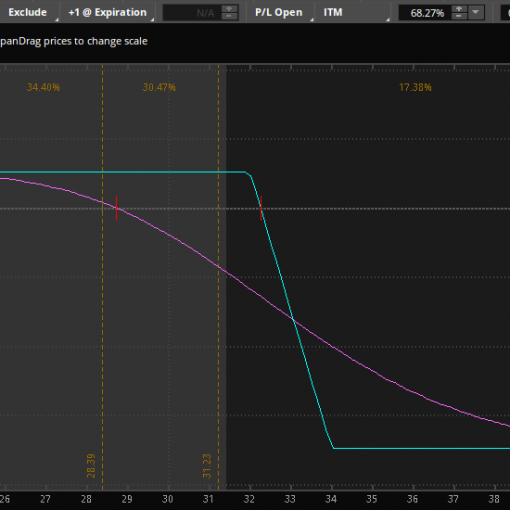

- Sell August 21st 40 put for 0.80

- Sell August 21st 55 call for 0.50

- This is called a Strangle

- Prices are at the midpoint as of market close on 6/19/2020

- Disclosure – I’m long shares of AOS and this is not to be considered financial advice

Note that this is a name that does Not have high option volume and the spreads are wide. I’ll be using limit orders to make sure I get filled at prices acceptable to me.

What can happen with this trade? At expiration:

- AOS ends above 55 – shares are called away at 55 and I gain $771 for the 100 shares plus the $50 in premium for the call plus the $80 premium for the put for a total gain of $901

- AOS ends below 40 – I purchase shares at an equivalent of 38.70/share (40 – 1.30 in premium collected).

- AOS ends above 40 but below 55 – I keep $130 in premium and stay long the same number of shares.

As a bonus, I will receive another $24 in a dividend that will likely be paid out in mid August.

When you set up a trade like this where you are happy to buy more shares at a lower price or sell them at a higher price, you really can’t lose. Before putting on a similar trade, consider a couple of extreme outcome.

- AOS ends at $100 – you will have missed out on $4500 of appreciation

- AOS ends at $10 – you will have lost ~$3k on the shares that you are obligated to buy at $40

For the first item, this is the same issue Any time you sell a call against shares. If you aren’t ok with this scenario, then you shouldn’t sell that call. Select a higher strike, sell a call spread, or simply don’t sell it!

For the second item, much like the first – don’t sell the put if you don’t want the shares. Alternatively you can sell a spread, taking in less premium, but capping your downside.

Currently, AOS pays $96 in annual dividends ($24 * 4) for a roughly 2% yield. With these types of trades, if the stock stays between 40 and 55, I’ll have added an additional $130 in income that I wouldn’t have if I simply held the stock. It comes with some potential risks, but as I am happy to buy 100 more shares at a discount or sell shares at a big premium, this type of trade can’t lose.

Not yet a member? Join Option Salary today!