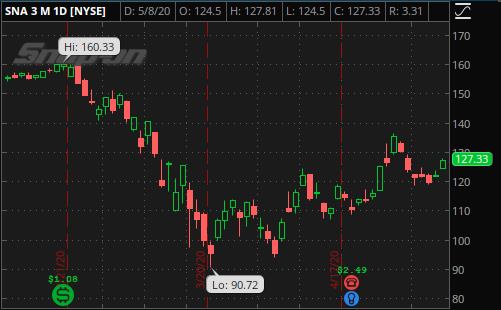

In case you missed it, the market has been volatile for the last couple of months. Snap-On (ticker: SNA), a high-end tool maker, has been moving around quite a bit as well as the three month chart shows:

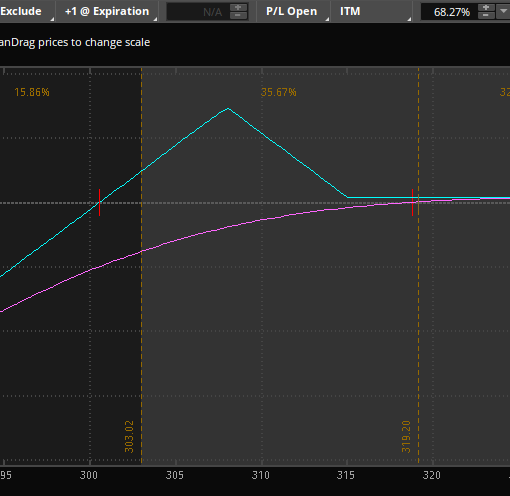

While the stock has come up a lot off its lows, it is still moving around a Lot and one would expect purchasing options to still be expensive, however when we take a look at the implied volatility, options are reasonably priced. In fact, this looks like a good time to purchase options in SNA:

Take a look a the implied volatility, which is well under the historical (or realized) volatility. The market is saying that the market will quiet down, SNA won’t move nearly as much as it has been. Let’s say we think the market is wrong, we can take advantage by buying options and then selling them for more if SNA continues its volatile ways.

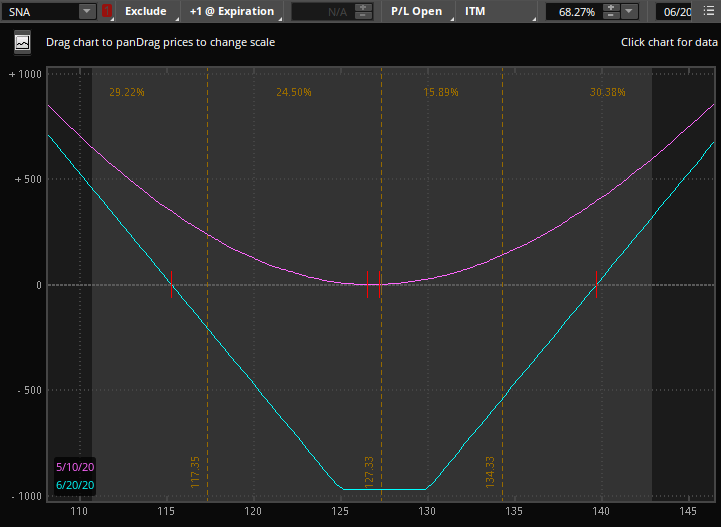

- Buy 1 June 130 call, buy 1 June 125 put for 9.71 at the midpoint

This is called a strangle. As SNA has $5 strikes we are unable to buy exactly at the money (a “straddle”). Normally, I would prefer to buy a July option to give the trade a bit more time, but that expiration isn’t available in Snap-on.

How does this position win? First, a P&L chart and then we’ll discuss the potential outcomes and how to manage the trade.

The ‘blue’ line shows the profit and loss at expiration. You can see that we need to be below ~115 or above ~140 at expiration to be profitable. That is a pretty decent move, but we have no intentions of holding this through expiration. The ‘purple’ line shows the P&L as of today and it will drift lower into the blue line over time as our options decay.

What we want to have happen is for SNA to make a big move in the next week or two and ideally have volatility increase, which will cause our options to increase in value and we can take the trade off for a profit.

It is important that if we do get the move we want, we take the profits as we’re fighting against theta. The stock can also easily return to the starting point and we’ll lose the profits. Either take the whole trade off or delta hedge with stock (or by taking off winning legs).

If we don’t get the move, set a maximum loss for the trade and simply close it out when it is reached. These options are worthless if SNA ends between 125 and 130 at expiration.

Questions? Reach out via email, Facebook, or Twitter.

Want more actionable trade ideas? Silver members are beating the market by a wide margin – Join us today!