Implied Volatility is fun. Really. I have mentioned before that I think beginning option traders focus on delta, then find out about theta (after long calls expire worthless) and start selling options, and then more advanced traders learn about volatility and incorporate it and all the Greeks (Ok, not Rho) […]

implied-volatility

A scan of my portfolio shows many trades that are short volatility/long theta. The trades benefit from little movement and time passing. This works really well – until it doesn’t. Rather than Always selling options, I prefer to have a variety of volatility hedges (VIX, SPX butterflies, etc.). I also […]

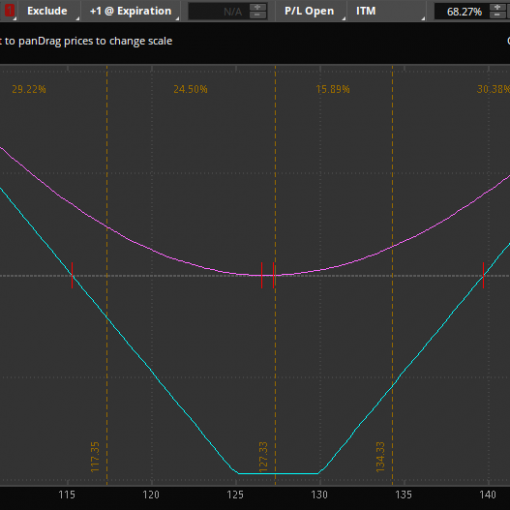

In case you missed it, the market has been volatile for the last couple of months. Snap-On (ticker: SNA), a high-end tool maker, has been moving around quite a bit as well as the three month chart shows: While the stock has come up a lot off its lows, it […]

When people refer to volatile markets, they often mean the market has dropped. The truth is that volatility is direction agnostic. While puts certainly can increase tremendously in value with the increase in implied volatility as markets plummet, we can see an increase in IV in the calls as well. […]

Which Greek do you focus on for your trades?

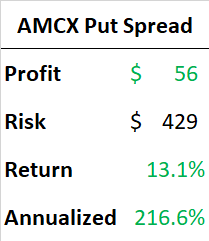

Breaking Bad, The Walking Dead, Better Call Saul, BBC America, Sundance, IFC – AMC Networks (Ticker: AMCX) owns them all. With content ‘king’, AMC’s portfolio of properties commands premiums from streaming giants like Netflix (Ticker: NFLX). There is, however, a lot of competition and AMCX was in a steady decline […]