A scan of my portfolio shows many trades that are short volatility/long theta. The trades benefit from little movement and time passing. This works really well – until it doesn’t. Rather than Always selling options, I prefer to have a variety of volatility hedges (VIX, SPX butterflies, etc.). I also look for opportunities where volatility is underpriced.

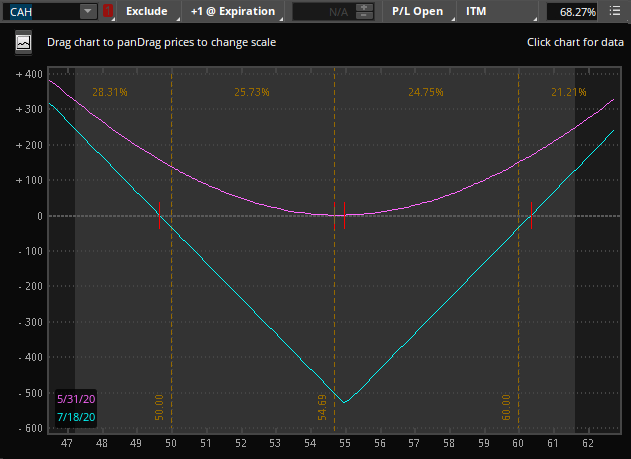

Today we discuss a trade in Cardinal Health (Symbol: CAH) where implied volatility is underpriced compared to its recent moves:

You’ll see the HV is 0.52 and IV is around 0.36 (absolute values). The IV percentage is significantly below the HV percentage as well.

If the stock continues to move more than the options are priced, how can we take advantage?

If we have a directional opinion or bias, we can buy puts or calls (or spreads). If we don’t, we should look at straddles and strangles.

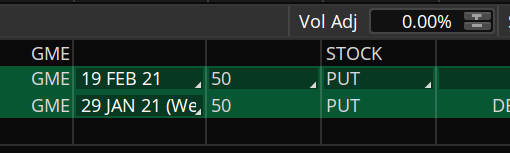

I am leaning -slightly- negative on the name, but really don’t have a strong directional conviction. I Do believe that the options are underpriced, though, and will go with a straddle:

- Buy 17 July straddle (1 put, 1 call) at the 55 strike for 5.35

- Prices are at the midpoint on 5/29

- All trades are for educational purposes only and do not constitute advice.

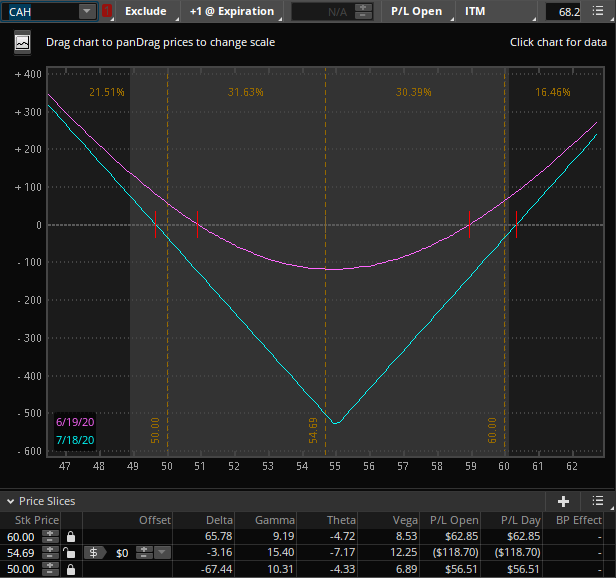

Here is what the P&L looks like ‘today’:

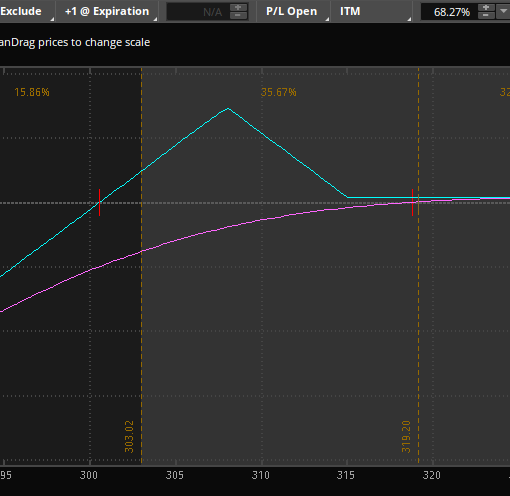

The market is saying that by expiration, the stock can move from a bit above 47 to between 61 and 62. I’ve set the slices to 50 and 60 as my targets with the thought that the stock can move ~$5 in either direction within a few weeks. With straddles and important thing to determine is how much you are willing to lose before taking the position off. This depends on your trading plan, position size, risk tolerance, etc. For the purposes of this post, we’ll assume we are willing to lose 25% of the straddle. You can use TOS to move ahead and see about when you’re at risk of hitting your max loss:

Basically by June 21st (a Sunday), if the stock is right where we started, we’ll lose 25%. In practice, we can target June 19th to take it off if we’re not happy with the result (shown above). Keeping the slices at 50 and 60 show that we’ll make more than 10% if on the 19th we hit one of our targets. We’ll make more if we hit the target Before the 19th (all else being equal).

One can manage this trade in a few different ways depending on how much “screen time” one has available.

Easy management – Check on the trade each day at lunch or a break. If the stock hits your target (profit or price level) simply remove it. If it doesn’t and has hit your max loss, close. Otherwise, wait until the next day

Harder management – determine scalping levels and “gamma scalp” by either removing legs of the position or by buying/selling stock to remain delta neutral. This is a much more active approach and the details go beyond the scope of the article.

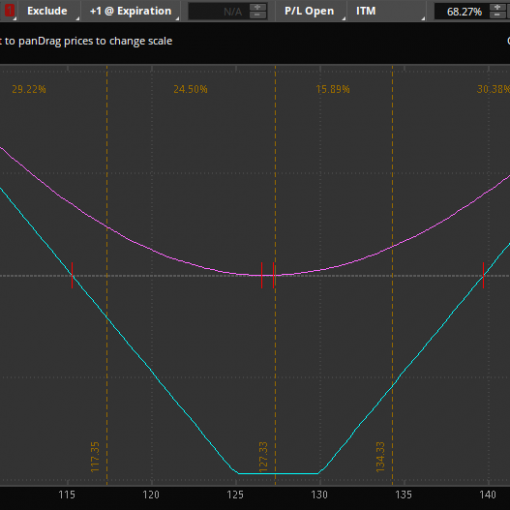

Another way we can win is for implied volatility to rise to match (or at least get closer) to the actual movement of the stock. Taking the P&L chart above and assuming the IV goes up 8 points (half the distance between the current IV and HV, we can see that our profit goes up significantly and our potential loss drops a lot:

Neat, right? Note that IV could also go down, which would hurt our position. This is one of the reasons that we look for a position that starts with a lower IV.

Straddles are not the easiest position to manage and are not for beginning traders. Having rules in place to protect against total loss and finding positions with favorable volatility setups will go a long way to trading straddles profitably.

Join Option Salary today for more trade ideas and education