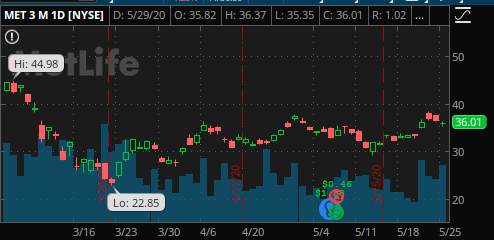

5/31/2020 Plan: This week we look at a neutral/bullish trade in Metlife (Ticker: MET)

5/31/2020 Plan (continued):

- MET sell 19 Jun 32 put for 0.38

- If you prefer to spread due to IRA restrictions or for margin purposes, 32/30 for 0.20 x2

- Prices are as of market close 5/29/2020, actual fill and strikes may differ depending on Monday open, post will be updated accordingly.

- All trades are for educational purposes and do not constitute advice

- As always, reach out with any questions!

5/31/2020 Commentary:

Metlife has recovered well and we expect the stock to continue to be stable. Its fundamentals are strong with a recent increase to its dividend. This is a nice stock for a wheel and for those that can take the shares, the recommendation is to sell the put outright taking in more credit now. If assigned, we’ll sell calls to get out while collecting over 5% yield. The immediate return on risk for a 3 week hold would be $38/$3162 or 1.2%, or over 20% annualized.

For a simple trade, you can put on 2 of the 32/30 put spreads for an 11% return if MET stays above 32 (20/180 = 11.1%).

6/1/2020 Entry:

The market opened down a bit this AM allowing for a nice fill on the put of 0.45 – 0.07 more than planned. With the market and MET recovering even a bit, it has already decayed to about 0.29. If put on for size and it was a trade, I’d consider taking the quick 1/3 profit and re-allocating funds. I still like the position, though, and will plan to hold longer to capture more premium.

6/7/2020 Update:

Wow, what a move up! The market took off on Friday and our put that expires in another 2 weeks is only worth 5-6 cents with MET around 40.74. You can definitely close this and move on to the next trade. Given we have 2 full weeks, you’d only be making $2-$3 per Week at this point and the market could always drop. I would only keep it on if you are hoping to take ownership of the shares at the 32 level.

6/8/2020 Update:

Closed the position for 0.04. A great win of 0.41 in just 1 week or 1.3% on total risk (if MET went to 0) or over 67% annualized. Any questions, reach out!