This week, we look at a little known company that supplies a key component in your cell phone. We don’t usually think about who makes are screen, but Corning (Ticker: GLW) has been supplying the glass for many years for many manufacturers with their “Gorilla Glass” (not made with real gorillas). Corning based out of Corning, NY has been making specialty glass and ceramic products for almost 85 years.

In the recent market plunge, GLW hit a low of 17.44. The 5 year low is 17.12. Earnings are this week on the 28th. The next dividend hasn’t been announced, but based on the past dates, it will be in late May.

GLW has been steadily increasing their dividend, with a recent increase to 0.22/share in February or 0.88/year. This is a 4.2% yield at current levels. While COVID-19 has impacted supply chains and Many businesses, my thesis is that people will (eventually) continue to buy phones. With the expected move of GLW around 2.40 between now and May 15th, we:

- Sell the May 15 17.5 put for 0.32

This is basically at the recent low and we would take ownership of shares at effectively 5 year lows. In addition, this would provide us with an over 5% dividend yield if we decide to hold the shares or wheel out of them (selling covered calls).

Let’s discuss what can happen with this trade:

- GLW stays above 17.5 from now until 5/15. We keep $32

- GLW finishes below 17.5 and above 17.18 on 5/15. We make between $0 and $32 if we close on the 15th or buy shares to offset the ones we are assigned.

- GLW finishes below 17.18. We are assigned shares at a loss equal to the amount below 17.18 ($18 if it closes at 17.00, for example) We are now long 100 shares at an effective entry of $17.18 (17.50-0.32).

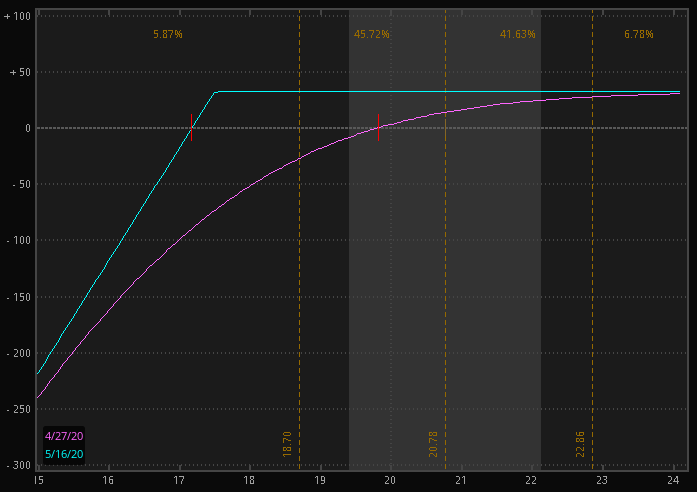

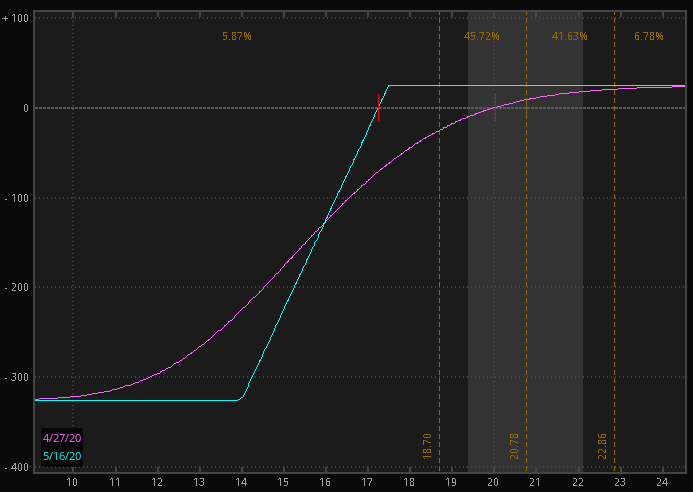

For those that prefer a P&L chart:

I think this is a great opportunity to own GLW at 5 year lows. If it expires worthless, you’ve made almost 2% on your total risk in less than 3 weeks. On the surface, The “worst case” is you are assigned shares and collect a 5% yield. Let’s spend a minute and talk about the deeper risk.

Corning has earnings on the 28th. While their results are likely minimally impacted by COVID-19 so far, they will be asked about future impacts. Depending on the market’s assessment of their statements, GLW could drop a lot. There is always a chance that they decide to cut or suspend their dividend.

In order to mitigate this risk, one can buy a 14 put for 0.08 turning this into a put spread. Net credit will be 0.24:

Want more trade ideas? Option Salary Silver members continue to beat the market this year – positive on the year vs. the S&P decline. Join today!

Not ready to join our paid or free memberships? Continue to support the free content at Option Salary by clicking the link to Amazon at the bottom of the page and making a purchase. It doesn’t cost you anything, but allows us to keep the (virtual) lights on.