Simply put, betting against Apple is a bad idea. I’m going to recommend it anyway. 10 years ago Apple (Ticker: AAPL) was trading in the 30s. It is currently, as of 5/15/2020 above 300, up over 9 times while the broader market is up less than 3 times. Buying and holding AAPL has been a great move, and I own some in my personal portfolio.

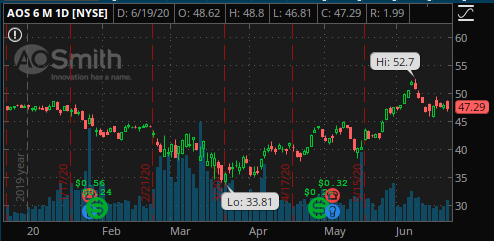

This week we’re going to fade AAPL, but first let’s take a look at the the chart over the last 6 months:

The chart is pretty consistent with a lot of tech names – incredibly strong over last several years, took a big hit in March and then rocketed back up. You’ll see the volatility has come way down since late March and the stock has also come off recent highs. The trade idea is to assume that AAPL doesn’t reach its all time highs over the next few weeks – which I believe to be a pretty safe bet with a nice return.

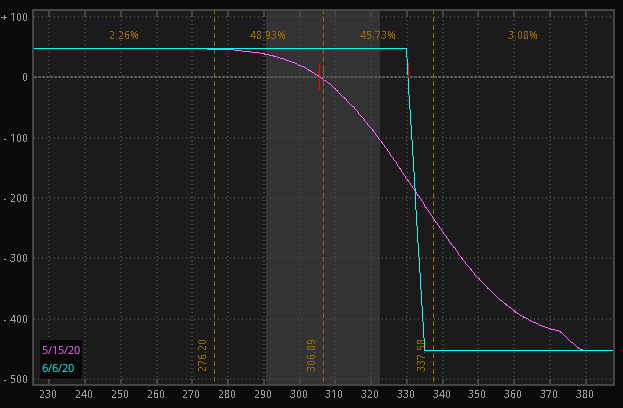

- Sell a 330/335 5 June call spread for a 0.47 credit

- Returns a bit more than 10% on the $453 risk if the options expire worthless

- All prices are at the midpoint as of 5/15/2020

- Trades are for educational purposes only and do not constitute financial advice

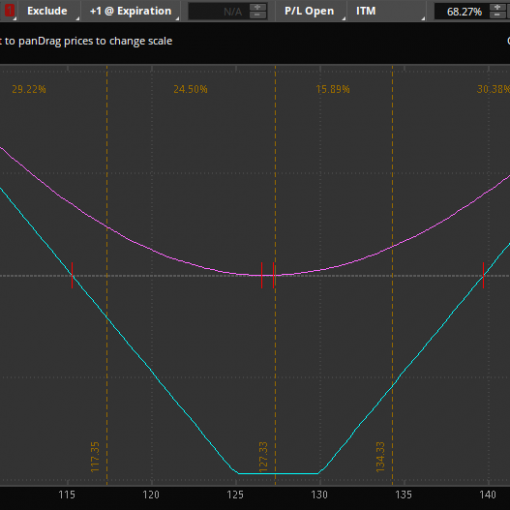

Let’s take a look at the P&L chart for the trade:

This is a pretty straight forward options trade called a vertical spread or a call spread. Other names you may here are “bear call spread”, meaning it is a call spread that we’ve sold and are bearish on the underlying. Here’s what can happen at expiration depending on AAPL’s price:

- <330: we keep entire $47 and make 10.4% on our money in just 3 weeks

- >335: we lose $453. AAPL would need to rally almost 9% for this scenario.

- Between 330 and 330.47 we remain profitable, losing $1 for every 0.01 above $330, breaking even at 330.47

- Between 330.47 and 335, we lose $1 for every 0.01 up to the max $453.

The previous all time high in AAPL was 327.85 hit earlier this year. While there are no guarantees, I think it is highly unlikely AAPL exceeds that all time high in the next few weeks given the uncertainty in the world right now.

Questions? Reach out via email, Facebook, or Twitter.

Want more great trade ideas? Join as a silver member today!