I don’t win on 100% of my trades. You don’t either. That’s to be expected. You can Estimate the probability of a trade winning in a variety of ways, but it is only an estimate and it certainly isn’t 100%! Sometimes you even place a trade and you are perfectly fine with losing on it. An example would be buying a put on a long stock holding because you are concerned of a near term drop in the stock, but don’t want to sell it. You are buying insurance and just like home owners insurance, you hope you don’t have to use it! This week, we take a look at a much smaller amount of insurance, but we get paid.

Specifically, we cover a trade I’m putting on that I’d be thrilled to lose on – selling a call spread in SPX:

- Sell 21 Aug 3340 call

- Buy 21 Aug 3345 call

- Net credit of 1.00

- Prices at the midpoint as of 7/2/2020

- Trade is for educational purposes only. This is not financial advice.

Note that one can certainly adjust the strikes, width, etc. to target a specific risk reward. This is just one example and you should feel free to experiment and make it your own.

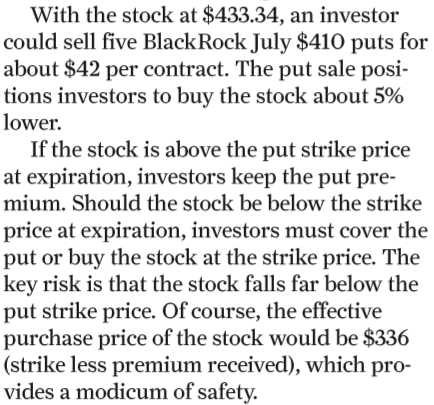

My overall trading and investment portfolio is bullish. This trade profits from SPX staying below 3340 over the next 1.5 months. If the market doesn’t rise by more than 210 points in the next 6-7 weeks, I’ll keep the $100 premium. If it lands exactly on 3341, I’ll break even. Anything above 3341 and I’ll lose up to a maximum of $400 at 3345 and above.

But – if the market Does rally by this much, the remainder of my portfolio (both long term investments and trading accounts) will make Much more than the $400 I’ll lose on this trade.

Effectively, selling call spreads is another way to hedge one’s portfolio. Note that the amount of ‘protection’ you are getting, is Very small and isn’t sufficient for a whole portfolio, but it does help. You can model how many spreads you want to put on based on the size of your portfolio such that you’re OK with losing the max on the hedge and if the market doesn’t take off, you still pull in a bit of extra premium at an acceptable rate.

For me, taking in 25% return on risk in <2 months is a great return on the cash [$100/$400 = 25%]. And if I lose on this trade, I’m certainly OK as I’ll have made much more overall in my portfolio.

If you have questions, please reach out via email, Facebook, or Twitter.

If you aren’t yet a member, join today for more education, trade ideas, and personalized support to learn to trade profitably in under 5 hours/week.