Remember October 2014? We were all eagerly anticipating the upcoming release of Big Hero 6. OK, maybe not. What is interesting about Disney in 2014 is that it was the last time you could buy the stock for $85.

Just one month ago, I wrapped up a Disney (Ticker: DIS) wheel trade, exiting near $143/share. With the recent market volatility, DIS is now trading near $115. Today I’m going to show you how you can enter a trade that will allow you to purchase Disney stock for less than $85 per share – a 45% discount to the recent highs.

Similar to last week’s recommendation to Keep Calm and Carry On, we will try to get long Disney buy selling an out of the money put. Note that Implied Volatility is at a year high in Disney – even higher than last week. We take advantage of this and put on the following trade:

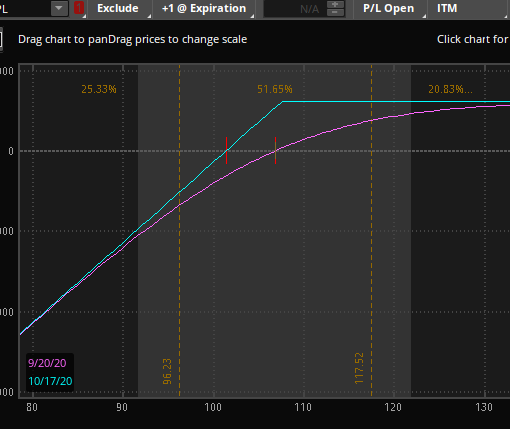

- Sell DIS 9 APR 85 put for 1.09 at the mid point

- Prices are as of the close on 3/6/2020 and will change upon market open on 3/9/2020

Trade Management

- If Disney stays flat or goes higher, we can let the put expire worthless, profiting $109. We can also close the short put for 0.10 to 0.20, especially if there is a drop in implied volatility, allowing us to reallocate our capital

- If Disney drops more than 26.2% in the next month, the option will be in the money (ITM) and we will be assigned. We will own Disney at an equivalent $83.91 per share. Given this is our stated goal, we’ll be quite happy with this outcome.

Takeaway – Investment portfolios have taken a hit recently and wild swings can cause quite a bit of stress. Markets are only down 8% on the year and the very high implied volatility allows us to enter names at multi year lows. Keep Calm and find ways to add to positions you want to hold for the long term. Join Option Salary for trade ideas every week!

Disclosure – Long Disney, Big Hero 6 was a commercial success ($658M Box office vs. $165M cost).