Yes I am using a motivational phrase produced by the British Government to talk about the US stock market. Last week’s market action, which may have Felt like a World War II air raid was not fatal nor as serious. The chart isn’t pretty, though, with the market dropping ~11.5% in one week.

So, do we panic? Sell everything and go to cash? No and No. Instead, let’s copy our British friends from 80 years ago and maintain a “stiff upper lip” and maintain a disciplined approach to our trading and investing. Keep Calm and Carry On.

In the midst of a sell off, particularly one dramatized by the media, fear, panic, hopelessness, are common feelings. Let’s sort through some of the noise to make you feel (a little) better and offer some ideas on how to take advantage of this drop and prepare for inevitable drops in the future.

The market has never fallen this much!

Turn off business television. True the Dow Jones Industrial Average (DJIA) has never fallen by more points in a day. This is primarily because the DJIA was practically at all time highs and a 1% drop now is significantly more points than a 1% drop 10 years ago (280 points on Monday vs 104 points 10 years ago). Using the raw number is click-bait and gets you to read articles or watch the show. Focus instead on percentage. Yes, we had a big drop on Thursday of 4.4%, but this doesn’t even make the top 20 on a percentage basis. As an aside, most professionals (or semi-professionals) do Not consider the DJIA to be “the market”. Most use the S&P 500. The media uses the DJIA because the number is much larger and allows for more dramatic stories. Ignore the noise.

No one could have predicted this rare event!

The reality is that we had a “correction” (usually defined as a >10% drop). Historically, these happen quite frequently – anywhere from 1x per year to 1 every other year, depending on how far back you go. Did it happen quickly? Yes. Is it painful to watch your net worth drop that much in a week? Absolutely. But it happened. And it will happen again. In fact, we’ll have bigger drawdowns in the future, so we might as well prepare for them.

My portfolio is shot/I received a margin call/I lost more than the market

Weeks like this are exactly why we keep our position sizes small enough to not be crippled by moves of this magnitude. In addition, we hedge with volatility products and actually Buy options as well. A lot of people have been buying calls or selling naked puts since the market “only goes up”. Do not over lever your portfolio, keep your positions smaller, and as you advance learn to use VIX and other products to hedge.

I’m selling all my positions and just going to cash (or bonds)

I know a lot of people that did this After the dot com bust and After the financial crisis/housing bust. Their portfolios have been trailing badly ever since. If you have more than 5 years until retirement, you need to stay exposed to the market to allow your balances to compound and to stay ahead of inflation. Do not buy high and sell low. If you aren’t comfortable trading in this environment, sit on your hands and watch. You should learn to be comfortable by watching, reviewing past similar events, and/or paper trading as quite a bit of profit can be made during volatile times.

So what do I do now?

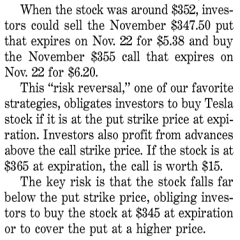

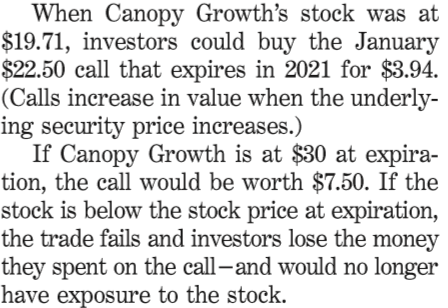

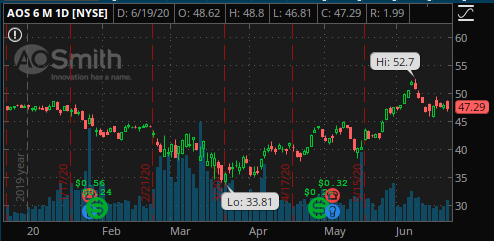

I’m going shopping and suggest you do too. I keep a watch list of names I’d like to add for my long term investments. With implied volatility still high, you can sell cash-secured puts on names that you want to hold for many years. Less than 3 weeks ago, Microsoft (ticker: MSFT) traded at 190.7. It closed at 162.01 (and was trading even lower on Friday). At the end of the day Friday, you could have sold the 140 put expiring 3/6/2020 for 1.13 at the midpoint. That is a 0.8% return in a week to agree to take MSFT if it drops another 13.5% by the end of the week. You can increase the strike to take on more premium and increase the chance of being assigned. Personally, I sold the 150 put for 3.10 and will happily take the shares at an equivalent 146.9.

Other ideas?

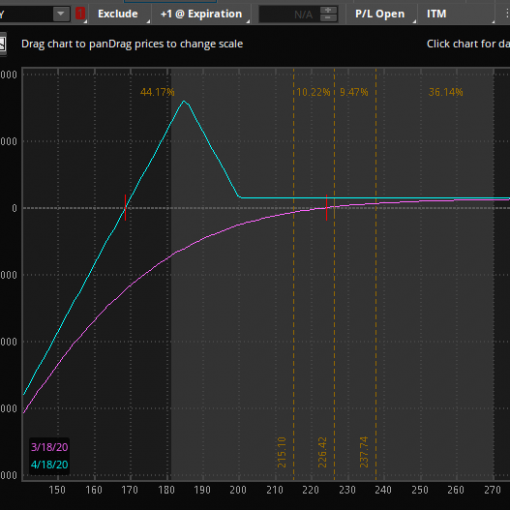

Implied volatility is much higher in the near term weeks than the out months, so if you are selling premium look shorter term, if you want to buy, go out further. You can also sell short term Against longer term to try and take advantage of this relationship. As a reminder, normally implied volatility is higher the further out you go. When the market is in backwardation during times of high stress, this relationship reverses.

How is Option Salary performing in a market like this?

The weekly trade that expired this past week went out at the max loss (put spread where both legs expired in the money). This was the first loser of 2020 and I expect next week’s trade to lose as well. With the S&P down over 8% in 2020, those that followed the Silver trades will still be up 2%! Why? We kept our positions small and didn’t chase results. While we can’t always expect to be positive on years the market is down we do intend to lose less.

Note that the Silver trades do not currently include many hedging trades, which can also help dampen losses during down markets. That will be a feature of the Gold Membership or with 1 on 1 mentoring.

Takeaways

- Corrections are normal and will continue to occur in the future.

- Keep your position sizes small enough so that you can trade another day.

- Take advantage of rising implied volatility and a declining market to add to your long term investments.

- You do Not need to trade in these environments.

- Keep Calm and Carry On

In the spirit of the WWII inspired quote, I recommend one of the best WWII movies, Saving Private Ryan:

2 thoughts on “Keep Calm and Carry On”