How to avoid FOMO. When it seems like everyone is becoming a crypto billionaire and cashing in on far out of the money options, how do we avoid the “Fear of Missing Out” trap?

The Underlying Business

The above chart shows an incredible run-up in BlackBerry as of January 27, 2021. In just a few short days it ran up from $7.5 to almost $29. Practically a 4x gain in the stock and countless riches for those that bought options. Of course, very few bought at the exact bottom and sold at the top. Many actually bought over those several days and are left holding the bag. BB is currently trading at 8.44 and may never see those levels again.

When you buy stock – remember that you are now a part owner of the underlying business. If you buy 100 shares of BlackBerry you own a (tiny) fraction of the company. You are pinning your hopes and dreams on the the world-wide leader of phones … as of 2011. Are you reading this on your phone right now? Is it a BlackBerry? No it is not. Don’t get me wrong, I loved my BlackBerry Way back when. Before I even had kids. I would not buy their stock, though, and I can happily avoid FOMO by passing over stocks that I don’t believe in.

Realistic expectations

There may be as many as 92,902 Bitcoin millionaires in the world as of the time of this article (source). We see all sorts of news stories about how they turned a small amount of money into enough to retire comfortably in just a few years. This is a great example of survivorship bias. For the almost 93k millionaires, countless others have lost a lot of money chasing the latest digital currency or meme stock. You don’t hear nearly as much about those.

There are over 10 million members on wallstreetbets. Yes there a couple huge winners, but there are just as many posts of people losing large sums of money as well, like this almost 7 figure loss in Disney that was just posted. How are you going to avoid FOMO and make your own millions? Probably not in Bitcoin, GME, or chasing the latest fad. Have realistic expectations, invest/trade for the long run and become one of the 46,800,000 millionaires in the world. That’s right, almost 47 Million people figured out how to be a millionaire without buying bitcoin…

Luck, gambling, pump and dump

How did people make so much money in [insert crypto/stock/fad here] in only [insert absurdly short time here]? In most cases, they were lucky, gambling, or involved in shady behavior. Yes, I know there are plenty of exceptions and this time is different.

If you walk into a casino and put your entire net worth on black at the roulette table, that’s gambling. Pretty straight forward. You have a 47% chance of doubling your money, 53% chance of losing it all. If you put your entire net worth into buying options just out of the money in a stock you “know” is going up, you have roughly the same chance of going broke. Still gambling. You could get lucky, sure, but is that really how you think the other 48M millionaires did it?

The reality is that no one knows what a stock, option, crypto, etc. will do in any given day. If people Do know, they often have inside-information or are engaged in a pump and dump. What we can do is look at past performance and make educated guesses, but we need to be humble enough to know that we’ll be wrong regularly and shouldn’t put our entire capital at risk in one trade.

Fads

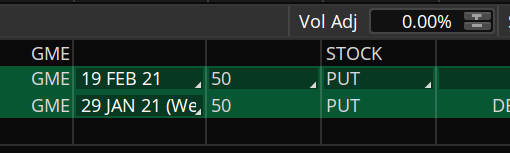

GME, BB, AMC and many others are often called “Meme stocks”. Much like the internet memes so cleverly passed around social media (sarcasm alert), these stocks will also reduce in popularity over time and be forgotten. Hard to believe it when we’re in the midst of the craze, but just spend a few minutes looking at fads from your years of choice and remember that this too shall pass. Would you rather have dogecoin, a closet full of Beanie Babies, or stock in a company that actually makes money?

How to Avoid FOMO

If we can avoid FOMO by focusing on buying things with intrinsic value, ignoring fads, and realizing that our chance of ‘striking it rich’ is akin to playing the lottery, how do we actually make more money?

Patience and discipline. The stock market as measured by the S&P500 has gone up almost 3 out of every 4 years (source), with an average annualized return of about 10%. That means we should generally have a long bias. By funding our investment/trading accounts regularly and allowing the magic of compounding to work for us, it is -relatively- easy to become a millionaire over time. For example, if you start with $35,000, contribute $500/month, and match the historical returns of the S&P500, you’ll have over $1M in 25 years. Play around with the calculations to fit your own scenario and set a plan to reach your goals.

Note – If you are not beating the S&P 500 in your trading and investing, I would suggest simply investing in a diversified basket of ETFs (or a target date fund) and spending your time on other activities.

Ok, let’s say you read through all of this and still can’t shake that FOMO – what do you do? Take a small percentage of your money and go ahead and try a crazy play or two. Want far OTM calls in XYZ? Think that Shiba Inu coin is legit? Think this time the roulette wheel is going to land on red? Go for it. It is ok to gamble with a little bit of money – but only if you can afford to lose it all. Sometimes having a ‘fun’ account can really scratch the itch allowing you to avoid FOMO.

Feel free to check out our free and paid membership options. Or reach out to us via email, Facebook, or Twitter with any questions, article requests, or just to say hello!

One thought on “How to avoid FOMO”