Well that sure sounds like a scammy title. I can’t cover Everything you need to sell options profitably in a reasonably short article, but this will give you some basics. Plus, I’ll share the last 6 months of trades to show some of the ups and downs that one can expect.

Slow and steady wins the race

I have put this first, because I think this is where most people who are new too options go wrong. Plenty of get rich quick scams are out there. You want to get rich slowly.

Measure the doubling of your account in years, not days, weeks or even months.

Common traps of trying to make too much, too fast:

- I’ve lost 80% of my account in a trade in ticker XYZ

- I made 10% on this trade in a month, and therefore should make 120% this year (or 280%+ since I’m compounding every month)

- How can I save this put spread I sold which is now completely ITM?

- Is $10k enough to trade on full time?

Let’s talk about each of these a bit.

Swinging for the fences

To use a baseball analogy, you want to hit lots of singles and doubles, not homeruns with every trade.

When there is a post of someone that has lost a huge amount of their account in one trade, they were going for the proverbial homerun.

If you want to consistently build your account, don’t do it. I don’t care it if was high probability – over a long enough timeframe, it Will go against you.

Extrapolating one result in perpetuity

While it is fun to do in Excel (or Google Sheets), taking one successful trade’s return and then simply annualizing that ‘forever’ is not realistic. I could make $10k on a $100k account in a week and if I extend that, I’d have a billion dollars in less than 2 years…

You will have losses and market conditions change. If you become the richest person in the world after extending your results during your lifetime, you’re way too optimistic (editor’s note: This does not apply to Elon Musk, an avid reader of my work).

A very worthy goal (putting you ahead of the majority of traders), is to try to beat the S&P 500’s historical return on a consistent basis.

Position sizing is important

This is, related to “Swinging for the fences”. Plenty of posts and questions out there asking how to save a trade that is already lost. If you are asking, it is (usually) too late. Take your loss and move on.

Any trade should be sized such that if the worst comes to pass, you dust your self off, move on, and your account is not crippled.

“But, I only have $x and even a $1 wide spread is a significant percentage of my account!”

Save more money. It hurts, I know, but if you have a small account, you need to be prepared to trade Very small and potentially lose it all if you can’t follow reasonable trade sizing.

I sell a lot of put spreads, puts, calls, call spreads. I work full time. If between Monday and Friday they go completely against me, it does not materially impact my account. I sleep easy.

No, your account balance isn’t enough to trade on full time

That is the correct response for 98.44% of people that ask the question.

What is the right account balance?

- Determine All of your annual expenses

- Review your last X years of consistent profitable trading and what return you made.

- Determine your tax rate

Your account balance needs to be high enough such that when you achieve your return (2) and take out taxes (3), it is enough to cover all of your expenses.

Example – you need $100k/year, you pay 33% in taxes and you can make 12%/year. You would need an account size of $1,243,781.10

Math: $1243781.1 * 0.12 = $149253.73. $149253.73 * 0.67 = $100,000

I would also include a buffer for when you have times that you make less than before (market conditions change, you have a life event that prevents you from trading for a period of time, etc.). I would also have a cash buffer for at least a year of expenses to give you some wiggle room. Have a back-up plan as well.

That’s a lot of money! Yep.

How to make money selling options

- Educate yourself. I’ve been trading options for about 11 years. I still take time to learn more. I think continued education is a good idea regardless of the profession or activity. Especially if your hard earned money is on the line.

- Be realistic. The subject of much of this post. Small position sizes, singles (not homeruns), set realistic return targets, and grow your account more before you go pro.

- Place trades based on the market conditions and your projections (price, timeframe, and volatility predictions). There’s a lot in this statement, but I’m running out of space…

- Determine your exit strategy Before you place a trade. Consider all outcomes. They will all happen if you trade long enough.

- Determine your exit strategy – from trading. You don’t have to trade. No shame in buying and holding broad index-based ETFs. That’s where a lot of my retirement money is, too. If you put in all the effort and still can’t beat the market, or you realize you don’t enjoy it, or you have a better use of your time, etc. then stop. Invest your money and pursue other activities

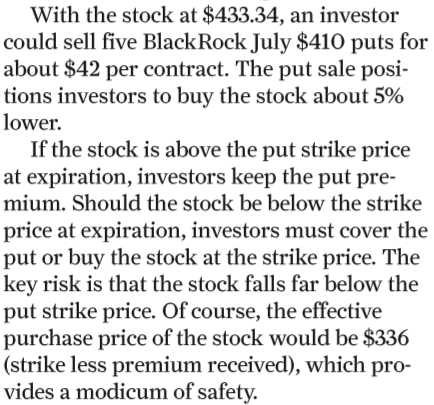

Example of how I’ve traded

I’ve been sharing my trades since 1/6/2020 (for free subscribers). I’ve just updated the site with the last 6 months of closed trades for everyone to get an idea of the trades I’ve taken here. I’ve personally taken a lot of other trades in my full account, these are just the public trades I’ve shared. Mostly winners (singles, doubles), but some nice losers (strikeouts) as well. It is just data, I didn’t go into the “why” behind each trade, but these are some of the tickers I follow pretty closely (you’ll see some repeats). Feel free to reach out with any questions.

Can I copy your trades?

You are obviously welcome to use those tickers and do your own research. I am closing Option Salary to new paid members at the end of the year (2022). So if you want to join, do so today!