Barron’s Education Can Be Flawed…

Steven Sears helped me get interested in Options through his weekly “The Striking Price” column in Barron’s. After receiving a ‘free’ Barron’s subscription for trading in some frequent flier miles, I would devour Barron’s week after week, looking for new stock ideas and being entertained by the likes of Alan Abelson (RIP).

An early column by Sears introduced me to the covered-call, which to me seemed like FREE MONEY for stocks I was willing to sell at a higher price.

While I found other ways to educate myself on options, I always enjoyed reading his column.

Over time, I have noticed that the media often has flawed options advice, ranging from minor, but confusing errors to advice that could cripple someone’s account. A recent column (subscription required) from Steven Sears has wrong information And can lead to serious losses.

Here is the relevant portion from Barrons, 10/21/2019:

See what is wrong?

This falls into the classic trap of “I bought a call, the stock went up, why didn’t I make any money?”

The issue is that an out of the money call option has extrinsic value and in a high priced stock like Amazon, these calls cost quite a bit of money!

Let’s look at the specific example described in the article. Goldman recommended a call purchase about $5 out of the money.

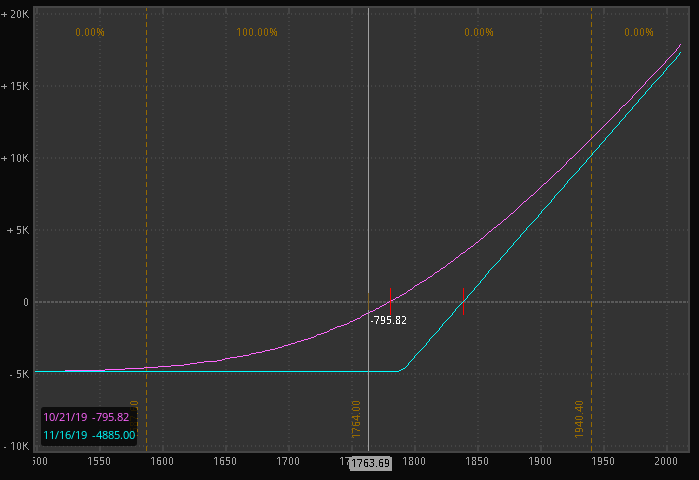

Using the closing prices on 10/21/2019, the day of the article, AMZN was trading at $1785.66. The 1790 15 Nov call was trading at a midpoint of 48.85. Per Steve’s column, “the trade will prove profitable if the stock is above the call strike price at expiration”.

This means that if the stock is at 1790.01 on the 15th of November, you’ll make money, right?

Wrong. One needs to take the strike price of 1790 and Add the premium paid of 48.85 for a total of 1838.85. If the stock is above $1838.85 you will make money (ignoring commissions):

How big of a mistake is this? Well, rather than being profitable at 1790.01, you’ll actually lose $4884 for every call you purchased! Buying Calls before earnings is a high risk play and isn’t recommended for many investors. Doing so without understanding your break-even is incredibly dangerous to your account.

The bottom line is that while Steven Sears is a long time columnist and Barron’s is a well known publication, media coverage of options is Not always correct. In this case, following it blindly could cost you thousands of dollars!

Show your support for Option Salary And Steven Sears and buy his book (or another item at Amazon). As an Amazon affiliate I will earn from this purchase, allowing me to to provide free content in the future!

One thought on “Faulty Education”