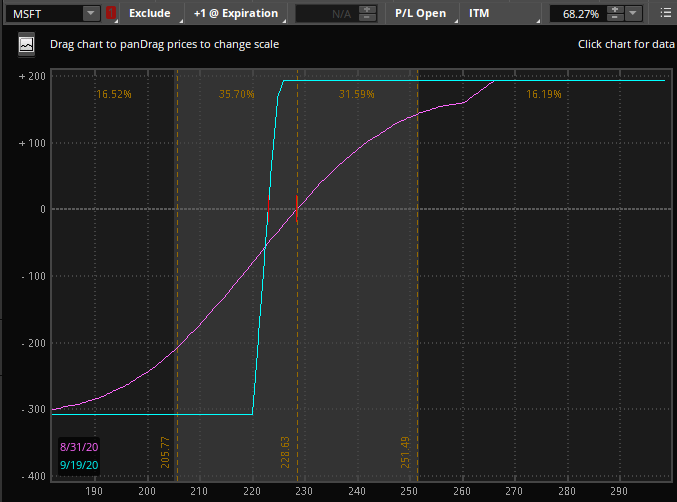

How well do you know your P&L charts? Good enough that you can quickly guess the underlying position? Take a look at the below and guess what it is (I’ll tell you later, try not to scroll and peek!):

I know this isn’t really a hard one. Yes it is MSFT – no tricks there. But what strategy is it?

Just buying some time here for you to guess.

I’ll get to the answer soon, really. Just scroll down.

Did you guess?

It is a long call spread, specifically:

- Long 1 220 18 September call

- Short 1 225 18 September call

- $3.05 total debit (Prices taken on 8/28/2020)

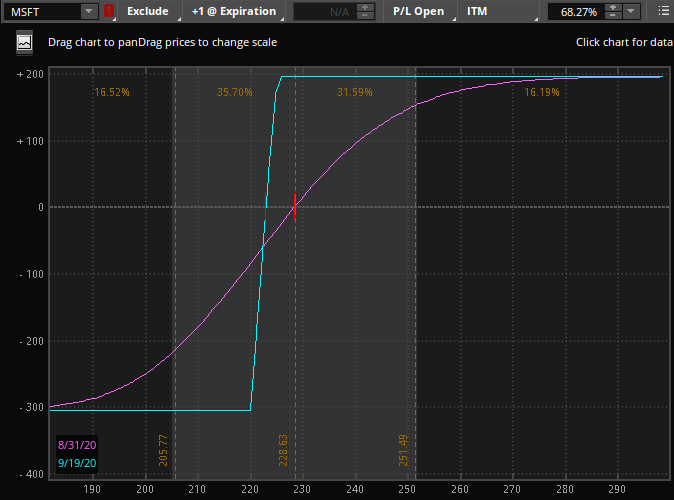

One more, and no annoying scrolling required:

Recognize this one?

It is a short put spread, specifically:

- Long 1 220 18 September put

- Short 1 225 18 September put

- $1.95 total credit (prices taken on 8/28/2020)

Are you sure you didn’t upload the same picture twice?

Yes (I double checked). The whole point of this gimmicky article is to point out that a call debit spread is the same as a put credit spread when done at the same strikes.

That can’t be right [insert guru here] says I should only sell options!

Your guru doesn’t understand synthetics. Find a new one [insert shameless plug here].

These positions are equivalent. The fact that the P&L charts are the same should make it clear, but let’s look at the numbers a bit.

Long Call Spread

We’re buying this call spread and will therefore have a debit of $3.05 and this is our total risk. If Microsoft ends above 225 at expiration on 9/18/2020, we’ll make $1.95. This is our max gain. Risk $305, potentially make $195.

Short Put Spread

We’re selling the put spread and will take in an initial credit of $1.95. This is our max gain. If MSFT ends Below 220 at expiration on 9/18/2020, we’ll lose the width of the spread ($5) minus the initial credit ($1.95) for a max loss of $305. Risk $305, potentially make $195.

Sometimes the prices are different!

There are definitely times when the pricing for these two strategies will be slightly ‘off’ by a few cents and one may look like a better bargain than the other. This can happen for a few different reasons, but is usually due to the bid/ask spreads and your brokerage calculating the midpoint. In most situations, you can pick whichever one is more favorable, but it is rare to get filled on Truly better pricing in one vs. the other. If you could, you would have an arbitrage – this is called a box spread (a subject for another day).

Dividends

I mentioned in -most- situations you can pick either one, but we do need to be aware of dividends. If the underlying has a dividend between the time you put on the position and expiration, I would suggest Avoiding deep in the money call spreads as you will be assigned on your short call if it is profitable for the option holder to do so.

But wait, there’s more!

This is just One of the examples of how you can create equivalent positions with options. There are many more. If someone tells you they only sell spreads because it is better to take in premium than buy it, they are still pretty early in their options education. Feel free to link them to this article!

Want to talk about option synthetics more? Who doesn’t?! Reach out via email, Facebook, or Twitter.

Want to trade options profitably in less than 5 hours a week? Who doesn’t?! (I already used that, sorry). Join Option Salary today!

One thought on “Guess the Option Strategy”