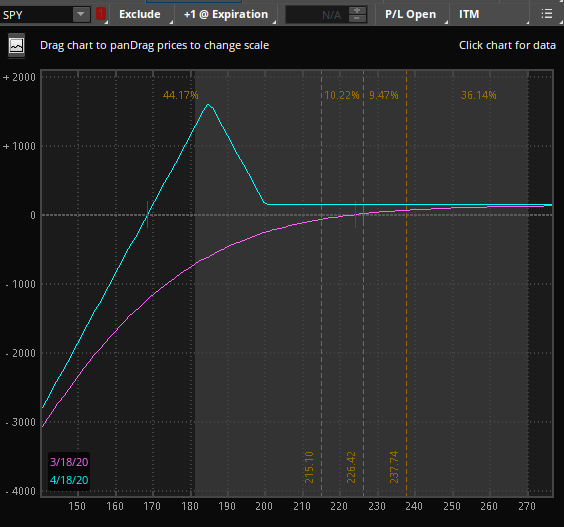

Limited time only! Everything must go! Generic marketing statement! As hard as it is to believe, the market was at all time highs closing on February 19th at 339.08. Here is a three month chart of SPY, showing that peak, plus our recent close of 228.02 on March 20th.

It has been a painful month for many, with incredible volatility in the market and most thoughts are on the COVID-19 pandemic. I realize that thinking about the market, making money, or retirement seems out of place right now, but there are opportunities to set yourself up well once we get past this situation. And we will. While we may have more downside in the market, I believe that we may have seen the ‘peak’ in volatility as measured by the VIX.

Let’s look at a way to buy the market at “half off” the recent high:

- We buy 1 17 APR 200 put in SPY and sell 2 17 APR 185 puts for a credit of 1.41

Here is a P&L chart of the trade:

Let’s discuss what can happen with a trade like this at expiration

- Market drops to 200, stays the same, or goes up – we keep $141 in credit

- Market drops below 200 but stays above 168.59 – we Still make money, up to $1641 if it expires at exactly 185 (which, to be clear, won’t happen).

- Market drops below 168.59 – we lose, dollar for dollar with the market as if we were long 100 shares of SPY.

With the market currently at 228, this trades allows you to buy at an effective price of 168.59. In case the math isn’t clear, we are short an extra 185 put, which means if SPY closes below 185 on the 17th of April, we’ll own 100 shares of SPY. We also took in a credit of 1.41 on the initial trade and we are long a 200/185 put spread which will be worth 15. 185 – 1.41 – 15 = 168.59

Please note – I wouldn’t put this trade on unless you are comfortable owning the market for 3-5 years.

Many people are trying to figure out when the market will stop dropping – the reality is that no one really knows. If we are comfortable owning the market at less than half of the recent highs, this type of trade is a great way to get long Well below the current levels and have a bit of downside protection along the way.

Join Option Salary today for access to more content including weekly trade ideas. Members are still positive on the year, compared to the S&P 29% decline (as of 3/20/2020).

All trades are for educational purposes and do not constitute advice

Not ready to join? Support Option Salary’s free content by making a purchase through Amazon. Your prices remain the same, but Option Salary gets a (tiny) cut to help keep the lights on. With the extra time at home, my kids and I are playing a lot of games. A current favorite is Rummikub that really is fun for the whole family. Our youngest is five and pretty competitive!