TAL Education Group (Ticker: TAL)

For those not familiar, TAL is a holding company and its subsidiaries deal primarily with after school tutoring. China’s market has held up reasonably well, and if you believe the data, they are past the peak of COVID-19 cases.

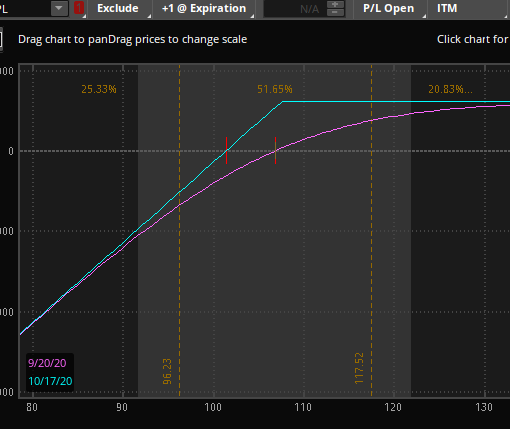

Trade Idea – Sell the 17 Apr 45/42.5 put spread for 0.20. A more aggressive approach would be the 47.5/45 for 0.5

Analysis – This stock came up with one of my screeners and upon further evaluation, I like selling some of the volatility in the name. Implied volatility is at the top of the range, but note it is still priced higher than historical volatility (also quite high). The intent is to take advantage of this higher IV vs. HV while limiting our risk.

Risks – As a risk defined trade, this is fairly easy to control. On a trade of only one week, I would size it so that a total loss (stock goes through both strikes) doesn’t cause significant pain.

Return – 8.7% on the 45/42.5 if held to expiration and TAL remains above 45. 25% for the more aggressive spread.

Disclosure – I currently have no position in TAL. Prices are at the mid point 4/9/2020 close. Markets have been volatile and I expect prices/strikes will change before I place the trade.

Looking to trade profitably while still working full-time? Join Option Salary today for trade ideas and additional education!

My neighbor let me borrow the last Star Wars movie – I’m excited to start watching the series with my eldest daughter – open to ideas on what order we should watch them! If you haven’t seen it yet, pick it up from Amazon and support Option Salary’s free content: