2020 has been an … interesting year so far, to say the least. In the last year, the market is up 2.29% and year to date the market is down 6.86% [SPX as of 6/26/2020]. These nominal returns hide the fact that we are in the midst of a global pandemic, there is civil unrest, and we had the fastest bear market and fastest recovery in history [Ok, I didn’t fact check this, but it was a quick recovery!]

At Option Salary we provide real results, shared publicly with everyone here. Members have access to to the trades before they are put on and see actual opens and closes (via the website, emails, and/or texts).

Now that we’re at the halfway point of 2020, we’ll compare our results to a simple buy and hold strategy, something that we work to beat over time. As I’ll be working on the 1st of July, the update is done over the prior weekend. All information is based on market close 6/26/2020.

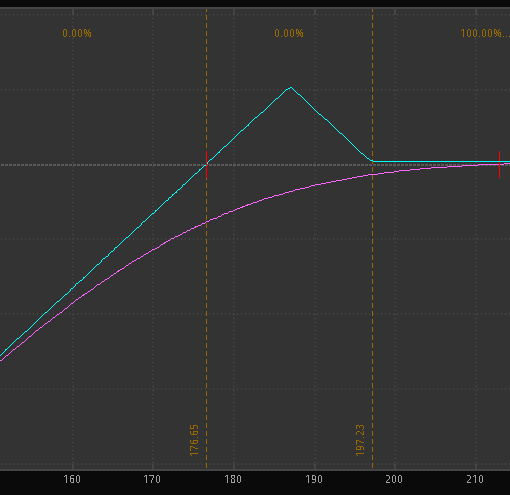

S&P 500 – The SPX is down 6.86%. Had we purchased “the market” with $25,000 at the beginning of the year and held until 6/26/2020, we’d have $23,285, a loss of $1715.

Option Salary – The Option Salary trades have returned 7.04% YTD. If one followed the trades and sizing guidelines, a starting balance of $25,000 would have grown to $26,761, a gain of $1761.

Results – Option Salary Silver members have almost 15% more in their account than those that simply bought and hold the S&P 500. In real dollar terms, Option Salary members would have $3476 more than buy and hold investors, for each $25k applied to these strategies.

Caveats –

- You can’t directly “buy” SPX, but there are numerous ETFs that track the S&P 500 and results would be similar. Dividends paid on SPY or similar ETFs, would narrow the gap a bit, with SPY returning negative 5.89% YTD.

- Option Salary trade sizes are based on a fairly conservative approach. More aggressive traders would have done even better, more conservative traders, would have done worse – but still ahead of the market.

- There are still 3 active trades that were put on during June (with one more coming). These are not included in the results as their outcome isn’t yet defined.

Past performance is not a guarantee of future performance. Will members always beat the market by 15% every 6 months? No. I can probably guarantee that!

This was a terrific 6 months for members, especially compared to the market returns. To be solidly profitable at all given the environment is great. A lot of people exited stocks after the market took a nose dive and haven’t necessarily gotten back in. I expect a lot are doing worse than the overall market being down 6-7%.

I want to take a minute and thank our members for their support as we’ve grown since launching at the beginning of the year. I certainly didn’t expect a global pandemic and that caused a lot of stress for many people. I hope that having a bit of a distraction by learning about options has been of benefit to our paid and free members. As a bonus, the small investment by paid members has resulted in gains over 10x the monthly fee!

If you aren’t a member, then what are you waiting for? Join us today! Silver membership rates will be going up soon as we continue to add more features. Once you are a Silver Member, your rate will Never go up as long as you remain an active member.

One thought on “Silver Trades – Mid Year Results and Review”