Have fun trading. Well a little bit of a fun at least. In between thousands of ‘standard’ trades, it is ok to have a bit of fun from time to time. I even suggested allocating a Really small amount of capital to gamble in a crazy meme stock (although lying down until the urge goes away is probably safest). I still think some of the best forms of trading are routine and boring.

Maintain your core strategies

I still think some of the best forms of trading are routine and often boring. If your primary strategies are making money and getting a bit stale – that’s actually a good thing. Some traders are perpetually break even (or lose) as they continually hop from one strategy to another. Day trading, penny stocks, [insert 1 of hundreds of technical indicators here], blackboxes, etc. Traders will often try a system, learn enough to understand the basics, not have immediate success (which is true when learning almost skill) and then they quickly bounce to the next system.

Once you are consistently profitable, your bigger issue will be fear of FOMO (again, covered here). You will be well served by ignoring the noise and maintaining your consistently profitable ways.

Have fun trading – how?

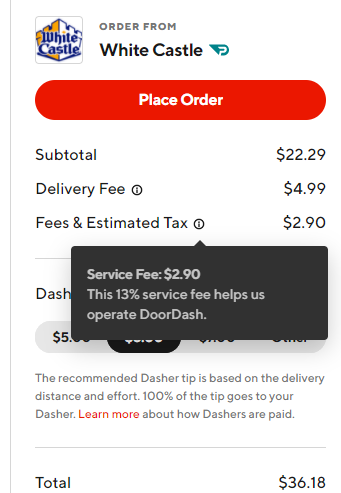

One of the things I like to do is allocate some funds to higher volatility stocks as a way to ‘juice’ a portfolio. To be clear, this is adding risk to our portfolio so definitely only do it with a portion that you are willing to lose. If you are patient and wait for good opportunities, though, you can often increase your overall returns and have a great outlet to keep engaged in the markets. and bring in a bit more upside. Let’s look at a couple examples.

Have fun trading Bitcoin

I am not a Bitcoin zealot. In fact, had to doublecheck the capitalization. Is it Bitcoin? BitCoin? BiTCoin? bItCoIn? Ok, pretty sure it wasn’t two of those four….

Anyway, my crypto holdings consist entirely of what I got for free through Coinbase along with some interest from a cash secured stablecoin that I partially converted to BTC and ETH to track out of interest. Basically a “free” way to watch them both.

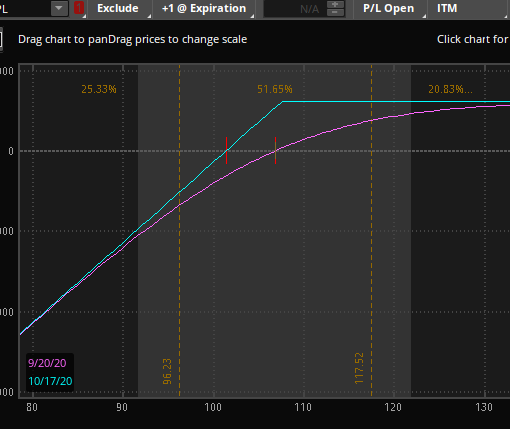

I like trading options, so I have dabbled in two different names – RIOT and MARA. Through a combination of short puts, covered calls, and some spreads, I’m up nicely on the year, have some exposure to crypto that I normally wouldn’t (and its correlation isn’t exactly tied to the market, which is nice).

Specific example trade, please…

Friday, during lunch (leftovers, they were great, thank you), I:

- Sold the July 2nd, 20 puts for 0.40

$40 credit for a 3 week trade. A bit more than 2% on the risk. That’s over 35% annualized or over 3x the average market return. It isn’t a “YOLO” trade, the single trade won’t allow me to retire, but it was fun. And I expect it to be profitable over time.

I’ll watch this one a bit more closely than a “set it and forget it trade”. Over the next few weeks, I can close it if it is quickly profitable, roll it to a further expiration/lower strike, or even take assignment of the shares. If I do the latter, I’ll likely set a stop as I’d prefer not to ride it to zero based on Elon’s latest tweets…

Speaking of which… after some favorable ‘news’ that TSLA may again except BTC in the future, BTC spiked and MARA opened up on the day. The puts are worth half what I sold them for and can be closed for a quick profit. With a higher risk trade like this, the opposite also could have happened.

Have fun trading – with all of my account?

No.

Remember this is with a small portion of my portfolio and it should be for you too. There are Lots of traders out there that are only used to meme stocks and high volatility. It won’t always be like this, which is why I have almost all of my trading account in more ‘stable’ trades. There are lots of people that thought selling puts was ‘free’ money and will be holding stock for a long time waiting for it to recovery (if it ever does). And that’s assuming people didn’t over leverage and blow out their accounts.

MARA is probably the highest risk position in my portfolio and I won’t risk much in it. I made a decent amount earlier in the year with some risk defined trades and am playing with ‘house money’. It is a trade, not an investment. With these types of trades, I prefer to get in after the stock has dropped and stabilized and then send a far OTM put with a good risk/reward (which can differ trader to trader). Another way to make sure you limit your losses is use spreads – it will reduce your potential profit on a trade, but guarantee you won’t lose more than a specified amount.

So yes, have (a little) fun with your trading to avoid burnout and keep the FOMO monster at bay. Do Not try these trades with your entire account as all you’ll have left is reddit coins in your account for posting your giant losses…

Feel free to check out our free and paid membership options. Or reach out to us via email, Facebook, or Twitter with any questions, article requests, or just to say hello!