This is the fifth in an series of pointing out faulty options education, primarily in Barron’s. I’ve passed on a few in the last couple months, but these basic errors need a bit of public shaming with the hope that editorial quality will improve.

What happened this time?

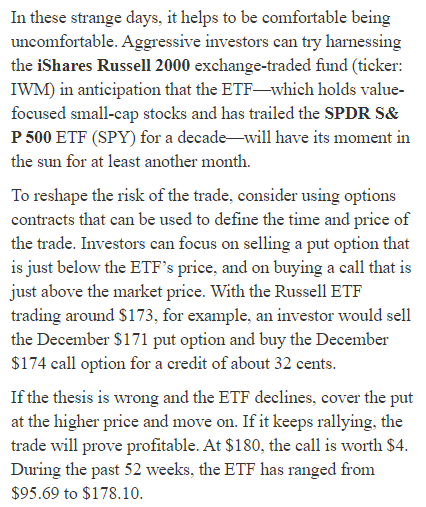

The November 16th, 2020 article recommends a risk reversal in IWM, which is selling a put and buying a call. Do you see the error?

Did you find the issue? “At $180, the call is worth $4”. A 174 call at $180 will be worth $6 at expiration, not $4:

(Stock Price – Strike Price) = Expiration Value of ITM call option

$180 – $174 = $6

Isn’t that basic Options Math?

Yes.

How could this happen?

It is clearly a mistake. A couple things are possible. The original recommendation is to sell the 171 put and buy the 174 call and take in a 0.32 credit. In reviewing the data, at about 2:30 PM on Friday 11/13, this trade could be put on for a 0.28 credit – about what is suggested in the article. By the time the article came out, IWM was at 173.50 and one would have to pay a 0.35 debit to put the trade on.

It is possible the recommendation was meant to be the 171 put and 176 call, in which case the end profit would be correct, although the size of the credit would be larger.

In either case, this remains an error. Barron’s coverage is more heavily focused on stocks. The column by Steven Sears is the only one dedicated to options. Perhaps those that are checking the article has less background in options.

I subscribe to Barron’s and generally find the content to be pretty good. The lack of attention to detail in their options content, however, is disappointing and can mislead investors that are new to options. There is a lot of faulty options education out there already, and readers of the newspaper should expect more.

If you are ready to learn to trade options profitably – join Option Salary for more free content today!