I’ve taken zero Uber rides since COVID-19 began. How many have you taken? Prior to the crisis, I’ve used the service quite a bit, especially when on business travel. It is convenient and links up nicely with my expense reports. The company loses a lot of money, so while the service is nice, I remain bearish in the name.

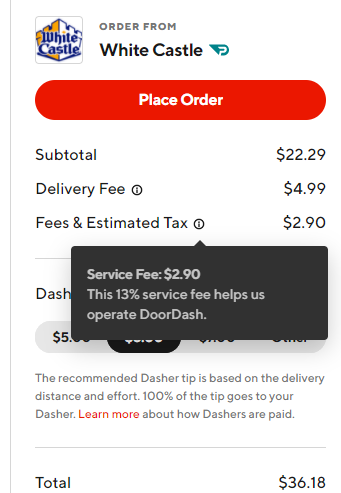

A common response is, “What about Uber Eats?”. With so many people ordering food and having it delivered, that must be great for Uber, right? No. Uber Eats lost $461 million in the 4th quarter of 2019. Food delivery is Amazing for consumers, but it is a very competitive and crowded market. Plus there is basically no brand loyalty – people will happily use whatever service is cheapest.

Uber (Ticker: UBER) has earnings this week – May 7, 2020, and this week we look at a bearish trade idea play in the name. Earnings plays aren’t the norm at Option Salary, but we’ve received lots of requests to show how one could play different names – so please enjoy and contact us if you want more via email, Facebook, or Twitter.

There are lots of ways to put on a bearish trade in Uber. With earnings and the high volatility in the market, purchasing puts is going to be expensive. Instead we will look at a spread to help limit the cost as well as the risk.

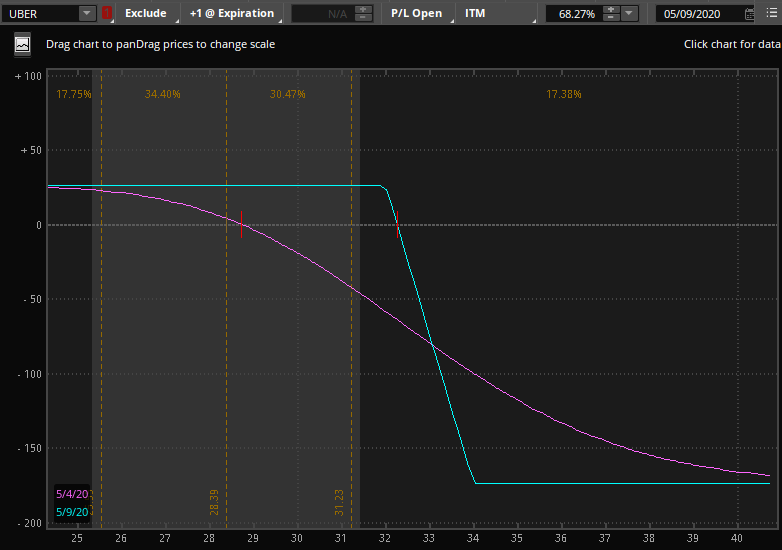

The market is pricing in a move a little over $3 in Uber by the end of the week. With Uber currently at 28.39, we:

- Sell the 8 May 32/34 call spread for 0.26 (at the mid point)

This is a pretty straightforward play, with almost a 15% return on risk in less than a week, P&L chart:

As earnings are on Thursday, if the trade doesn’t go your way, you won’t have much time to adjust. Sizing should be small enough that a complete loss doesn’t hurt your overall account.

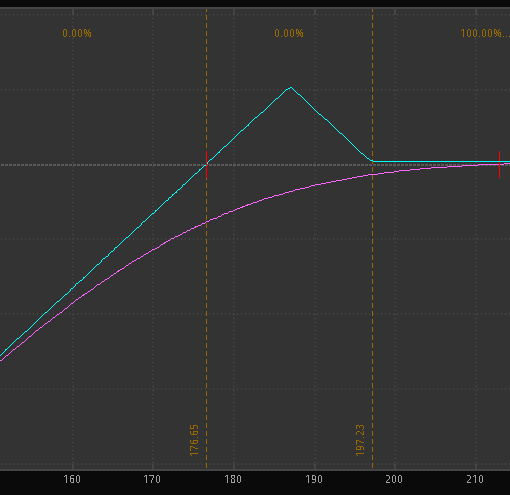

As an alternative, one could go out another week. You can set up a similar risk/reward by selecting higher strikes (33/35 for example), or you could take a larger credit with the same strikes:

- Sell the 15 May 32/34 call spread for 0.42

- Note the 32 call has a wide bid/ask, the above assumes the midpoint.

- This provides a potential 26% return on risk for a little under a two week hold.

As always, this article does not constitute financial advice and is for educational purposes only.

You can become a Silver member and receive weekly trade ideas and personalized support to help you learn to trade profitably in under 5 hours per week. Silver Members are up on the year compared to the market that is down over 12% (as of 5/1/2020).

One thought on “Uber Earnings Play”