This week we look at a bullish play in my favorite company in Idaho. No, not ADM Edible Bean Specialties (Ticker: ADM), but the maker of computer memory, Micron (Ticker: MU). Apologies for not making the obligatory potato joke. A 6 month chart shows that Micron has recovered much of the March COVID-19 drop, but not all:

Further, we see that historical volatility has come down significantly, but implied volatility remains a good deal higher (Make sure to look at the absolute value of IV as well). To take advantage, we look to sell some options, in one of two ways:

- Sell 21 August 42.5 puts for 0.51

- Sell 21 August 45/42.5 put spreads for 0.40

- Price is at the midpoint as of 7/17/2020

- All trades are for educational purposes and do not constitute financial advice.

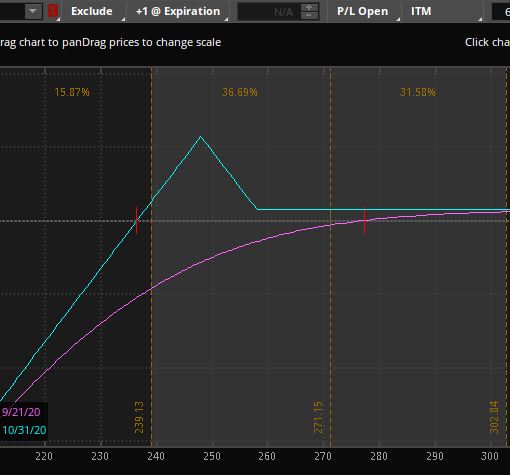

If you want to consider MU as a long term holding, selling a cash secured put will get you in close to $42. As a pure trade, the put spread offers a nice return on risk if the position expires worthless. 19% for a little over a month ($40/$210 = 19%).

There are no earnings during this time frame, which is a benefit to this type of trade (we don’t want movement).

One risk, as with any placed while the world battles COVID-19, is an overall market drop that takes MU with it, much like what occurred in March. Here are a couple ways you can offset some of this risk:

- Sell a call spread, like the 55/57.5 for 0.36. This requires MU to stay within the 45-55 range at expiration and one takes in a total of 0.76 (assuming the put spread is selected)

- Maintain a smaller position size. Put on less spreads than normal to limit the overall risk to your account.

If you have questions, please reach out via email, Facebook, or Twitter.

If you aren’t yet a member, join today for more education, trade ideas, and personalized support to learn to trade profitably in under 5 hours/week.