This week, let’s figure out how to cover the cost of an overdraft fee. Actually, you’d need to do the trade two times to cover the cost ($35!), but it is a good way to build up your trading account with a low risk, good reward trade.

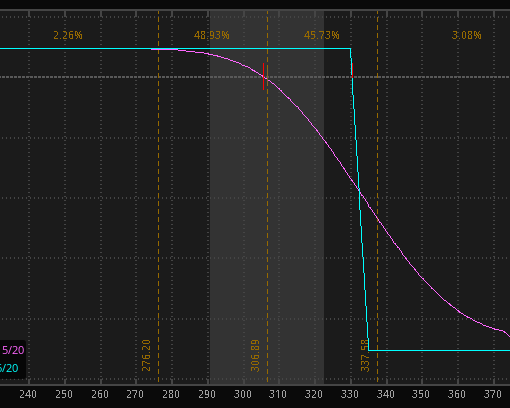

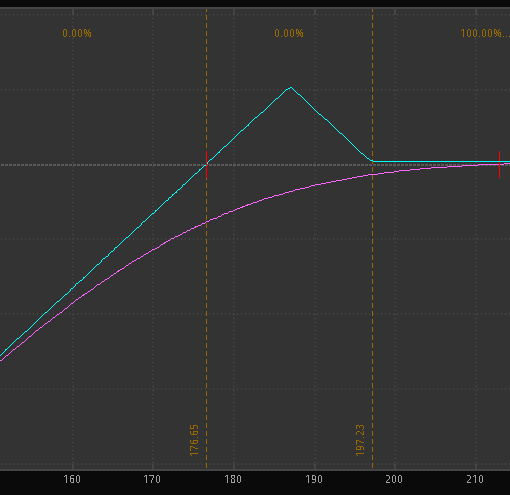

First a chart of the second biggest bank in the US – Bank of America (Ticker: BAC):

- Sell August 21st 22 puts for 0.25. This is a cash secured put sale.

- Price is at the midpoint as of 7/24/2020

- All trades are for educational purposes and do not constitute financial advice.

Why? With earnings now past in the major banks, we expect less movement in the name and volatility to continue to decrease/stay level. 22 is an attractive entry level for BAC and if assigned, will provide a 3.3% yield (see note 1) on the shares while they sell call against the position or simply hold the shares. The probability of the option expiring worthless is high, in which case we keep the entire $25 premium for each put sold.

$25? Big deal. As with any trade, one needs to consider the return on the capital risked. For this trade, the max loss occurs if BAC goes bankrupt and the stock falls to zero. That would result in a loss of $2175 ($22 * 100 shares, minus the $25 premium collected). Therefore our return on risk is 1.15%.

1.15%? I can’t believe I’m still reading this. Next, one needs to consider the annualized return of a trade. If you place the trade on 7/27, there will be 25 days until the position expires. 365/25 = 14.6. You then take the 14.6 and multiply by the 1.15% to get an annualized return of 16.8%. Another way to look at it is since we based the pricing on 7/24 is as a 4 week trade. 52/4 = 13. Multiplied by our 1.15% and you get an annualized return of almost 15%.

A 15-17% annualized return over time crushes the overall stock market’s long term returns of ~10%. If one can find and place similar trades in their account over time, they will build their account faster than simply buying and holding the market.

Downsides? The implied volatility levels aren’t tremendous. I would prefer that IV was Above HV, but they are fairly close. My view is that realized vol continues to go down. One should also be comfortable holding BAC to put on this trade. While assignment is a low probability, that is Not the same as 0.

Notes:

1 – ($0.18 quarterly dividend * 4)/22 = 3.27%. Dividend likely to continue increasing over time, not included here.

If you have questions, please reach out via email, Facebook, or Twitter.

If you aren’t yet a member, join today for more education, trade ideas, and personalized support to learn to trade profitably in under 5 hours/week.