The Russell 2000 has lagged behind the S&P 500 and Well behind the Nasdaq 100 (pretty much everyone is lagging behind the QQQs…). This past week IWM (iShares Russell 2000 ETF) hit its highest levels since February. I had taken the opportunity to sell a call at the 156 level a while back and with Friday’s close of 156.17, I had shares called away.

I remain bullish in the market over the long term. Over the short term, who knows? What I would like to do is get back into IWM, but at a lower price. I can do this in a variety of ways:

- Buy the ETF outright at 156.17.

- Buy a call or call spread

- Sell a put

- Sell a put And buy a call (bullish risk reversal)

- Ratio spread

How do we choose? There are pros and cons to each and we should select based on a variety of criteria. I’ll cover why I’m choosing #5 and you can contact us if you have questions on when/why you’d select some of the other options. The trade:

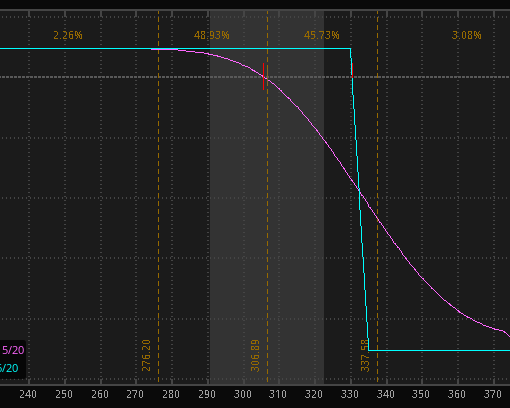

- 9/4/2020 Expiration, Buy 1 155 put, sell 2 150 puts for a credit of 0.96

- Prices are at the midpoint as of 8/7/2020

- All trades are for educational purposes and do not constitute financial advice.

Reasoning behind the Trade:

I don’t want to simply buy back the shares I was just called away on. This is Option Salary, not Stock Salary! All kidding aside, I do buy stock, but that wouldn’t make for as good of a post…

The Implied Volatility is really quite favorable compared to the historical volatility and I want to sell it. That eliminates buying a call outright.

The risk reversal is tempting – one could sell a 150 put and buy a 162 call and receive a 0.57 credit. We receive the credit thanks to the skew (puts traditionally are more expensive than calls in most equities).

Selling a put outright works as well. In fact you can sell a 140 put and take in an equivalent credit.

One nice feature of the 1×2 ratio spread is that you can make quite a bit more than the initial credit if the underlying stays inside your ‘tent’ created by the spread, in this case between 145 and 155. As we are short term cautious about the market and expect some pull back, we like having that additional profit potential. A good example of this was in a free trade we provided on SPY (Go Long Spy at Lower Levels). SPY ended almost at the exact peak and was a great winner for those who took it. This won’t Always happen of course.

Possible Outcomes:

- This spread will make $96 if IWM expires above 155.

- It will make more if it expires between 145 and 155 (Max of $596 Right at 150)

- It will break even at 144.04

- It will lose as if we were long stock below 144.04

Summary:

We Want to get long again and if we’re assigned shares it will be at a level below where we were just called away. The expected move of IWM falls within our additional profit window of 145-155, which gives us an opportunity to capture more than just the initial credit. If the market continues to go up, we will only have the $96 credit. One should make sure they have enough bullish exposure outside of this position. If not, than the risk-reversal may be a nice option.