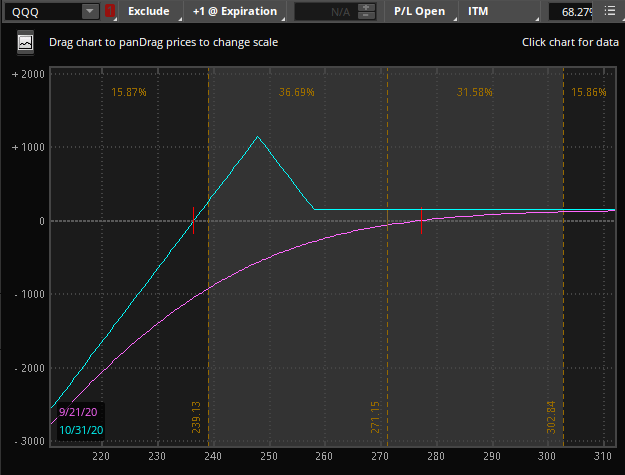

QQQ has returned over 28% this year (as of 9/25/2020). Just a few weeks ago, it was even higher topping 300. Made up primarily of “tech names”, it is well ahead of the other index-based ETFs as investors and traders bid up names that have done well in a pandemic. Another way to look at QQQ is as a proxy for 3 of the biggest names – Apple, Microsoft, and Amazon – which make up about 35% of the index as it is market cap weighted.

A review of the chart shows that QQQ dropped like everything else in March, but its recovery was certainly v-shaped:

Long term I remain bullish on the stock market as a whole as well as technology. If I could go back and load up some more on QQQ at pre-COVID levels, I would. Today, we look at a way to get paid to try and buy shares at the pre-COVID peak.

The trade is a ratio spread, specifically a put 1×2. The trade:

- 10/30/2020 Expiration, Buy 1 258 put, sell 2 248 puts for a credit of 1.44

- Prices are at the midpoint as of 9/25/2020

- All trades are for educational purposes and do not constitute financial advice.

Possible Outcomes:

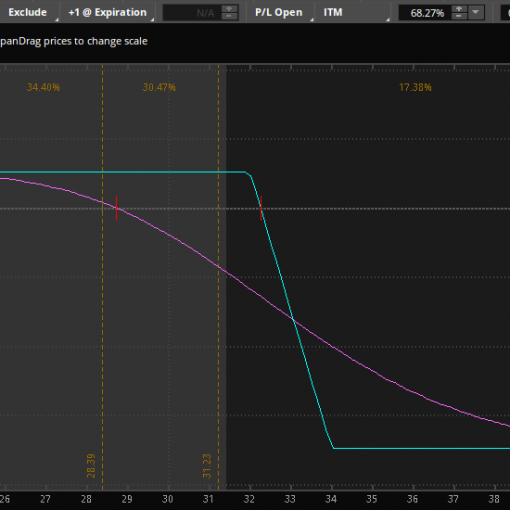

Here is the P&L graph of the position:

- This spread will make $144 if QQQ expires above 258.

- It will make more if it expires between 238 and 258 (Max of $1144 Right at 248)

- At 236.56, we break even

- It will lose as if we were long stock below 236.56

Pros to the trade:

If we are assigned, we’ll be long shares at an equivalent of 236.56, which is below February 19 peak of 237.47. If not, then we get a nice credit of at least $144 and a shot at a much higher credit if the stock ends up between 238 and 258.

The expected move (based on the straddle) puts QQQ near 250, which is close to our peak profit. The 1 sigma move per TOS, which is shown in the above picture, puts QQQ around 239 on the low side.

In other words, if the market moves down and is close to the expected move, we’ll end up in our profit “tent”.

Cons to the trade:

[Insert obligatory COVID-19/pandemic comment here that anything could happen]

We need to be willing to take ownership of 100 shares at an equivalent 236.56 (Technically, we’d be buying shares at 248). Depending on the portfolio size, this is roughly $25k.

$144 on $23656 of risk is not a tremendous return for a 32 day hold. It is about 0.6% for the holding period or about 7% annualized.

Counter point to the %return con:

While strictly our risk is $23656, the probability of QQQ going to 0 approaches zero. This would mean that all ~100 companies go bankrupt and their shares become worthless. As an ETF based on an index, if a company does go bankrupt, it will almost certainly be replaced with another (not bankrupt) company. Last, if AMZN, MSFT, FB, AAPL, etc. all go bankrupt, we have a much bigger issue on our hands…

The point is that our risk is likely quite a bit less, which increases our return.

In addition, we have an opportunity to make quite a bit more than the $144 if QQQ ends up between 238 and 258. A good example of this was in a free trade we provided on SPY (Go Long Spy at Lower Levels).

On portfolio margin the trade will use approximately $1500 of margin. For those that consider return on margin, this is obviously a much more favorable potential return percentage.

As a reminder, placing this trade requires one to Want to go long QQQ at pre-COVID levels. The ratio spread is another way for traders to try and get long at lower levels and have the potential for a higher return than simply selling a put.