4/30/2022 Plan: This week we take a look at SPY (Ticker: SPY) 4/30/2022 Plan (continued): SPY – Buy the Jun 3rd 410/392 1×2 put spread for a 1.87 credit Note – large accounts only Prices are as of market close 4/29/2022, actual fill and strikes may differ depending on Monday’s […]

1×2

This week, let’s take a look at one way to try and buy the popular Russell 2000 ETF, IWM, for 10% off its current levels. As a bonus, we’ll get paid to do so. First let’s take a look at the chart over the last 6 months: You can see […]

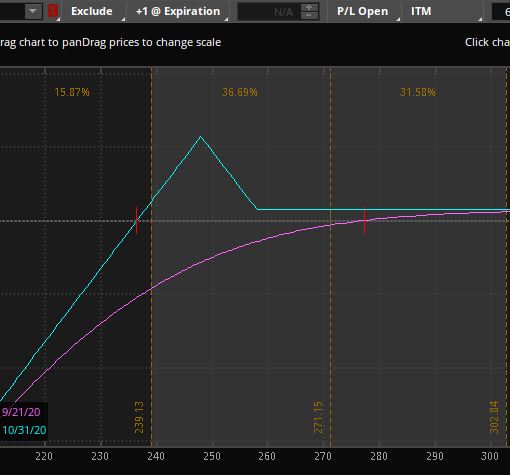

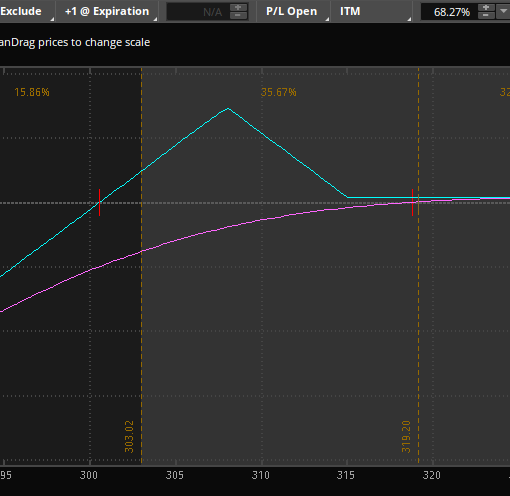

QQQ has returned over 28% this year (as of 9/25/2020). Just a few weeks ago, it was even higher topping 300. Made up primarily of “tech names”, it is well ahead of the other index-based ETFs as investors and traders bid up names that have done well in a pandemic. […]

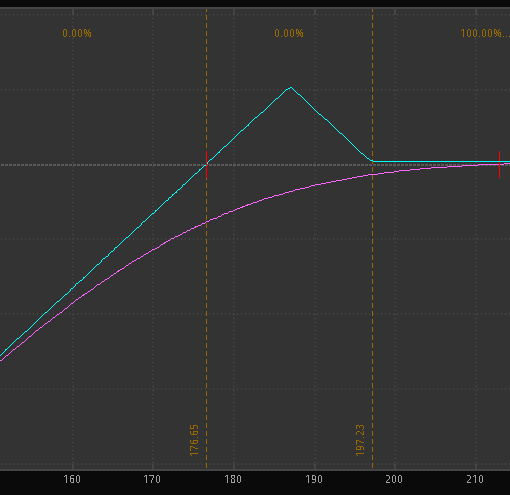

The Russell 2000 has lagged behind the S&P 500 and Well behind the Nasdaq 100 (pretty much everyone is lagging behind the QQQs…). This past week IWM (iShares Russell 2000 ETF) hit its highest levels since February. I had taken the opportunity to sell a call at the 156 level […]

In case you missed it, the market shot up almost 5% last week. With this big move, I had some shares of SPY called away on Friday (short call against long stock). This week we discuss a few ways to get right back into the market to position ourselves to […]

6/7/2020 Plan: This week we look at a couple different ways to play Disney (Ticker: DIS) 6/5/2020 Plan (continued): DIS sell 26 Jun 115/113 put spread x2 for 0.30 or DIS buy 17 July 120/115 1×2 puts for 0.80 credit if you want to get long DIS at lower prices […]

5/3/2020 Plan: A wild week last week and the end result was the market was close to unchanged (down 0.2%)! Two very different trade ideas this week to consider. One will use most of our buying power and another is a rinse and repeat trade that closed this past Friday […]

Want to hear something crazy? The NASDAQ is actually Up on the year. That’s right, if you bought an ETF tracking the NASDAQ, like QQQ, on 12/31/2019 you are actually now profitable: Hard to believe given the plunge we saw from a mid Feb high of $237 all the way […]