Want to hear something crazy? The NASDAQ is actually Up on the year. That’s right, if you bought an ETF tracking the NASDAQ, like QQQ, on 12/31/2019 you are actually now profitable:

Hard to believe given the plunge we saw from a mid Feb high of $237 all the way down to the ~$165 low about a month later. We are up over 30% since that March low and for those lucky enough to have bought near that bottom, they are sitting on tidy profits. If you missed buying the dip at those low prices (and almost everyone did), I’ll share a way to try and get in at lower prices again.

Recently, I sold out of a long QQQ position when my shared were called away – I was short a call for each 100 shares I owned. Now I’m looking to get back into QQQ at a much lower level and I’ll do so with a 1×2.

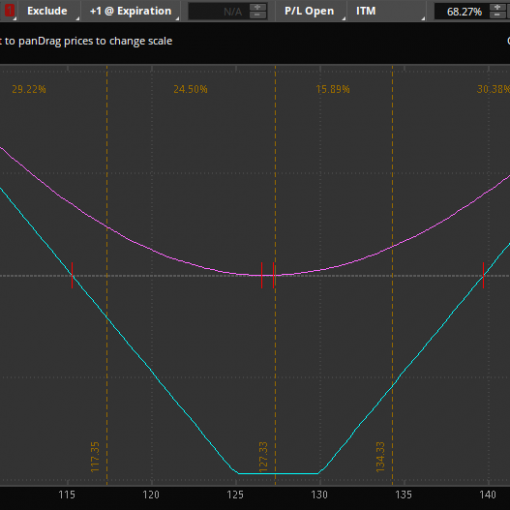

- We buy 1 15 May 197 put

- We sell 2 15 May 187 puts

- We take in a credit of 0.41 (midpoint pricing as of 4/17)

Let’s discuss what can happen with this trade and then we’ll discuss why one would (or wouldn’t) put it on

- QQQ stays above 197 from now until 5/15. We keep $41

- QQQ finishes between 197 and 187 on 5/15. We keep $41 Plus we profit from 197 to 187, $100/point. If QQQ finishes at 191, for example, we make $47 + $600 = $647

- QQQ finishes below 187. We are now long 100 shares at an effective entry of $176.59 (187-10-0.41).

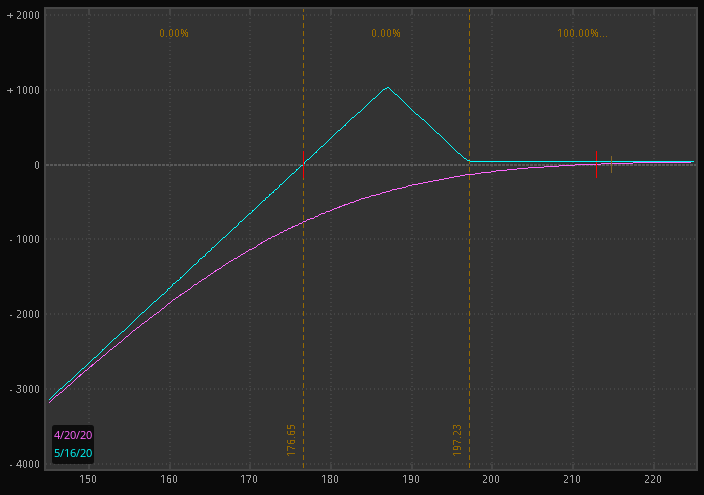

For those that prefer a P&L chart:

Who should put this trade on? I only recommend it for those that are willing to own QQQ at 176.59 or about 18% below current levels. This means you should have the almost $18k in your account in cash. If you want to trade a position like this because you think the market will slide down to the 180-190 range, I’d recommend turning the position into a butterfly by purchasing one more put near the 177 strike. If the market does have a “double dip”, this can be a great way to get long again at lower prices. If the market continues up, you’ll still pocket an extra

Realistically, you can’t plan to buy at the bottom or sell at the top. You can, however decide what prices you are willing to buy or sell at and then set up options trades to do so. This is one of the many reasons I love trading options.

QQQ consists of many tech names and is one of the few indices positive on the year. The S&P 500 remains down over 10%. Option Salary Silver members remain positive on the year. Join today and learn to trade options profitably in under 5 hours per week!

Not ready to join our paid or free memberships? Continue to support the free content at Option Salary by clicking the link to Amazon at the bottom of the page and making a purchase. It doesn’t cost you anything, but allows us to keep the (virtual) lights on.