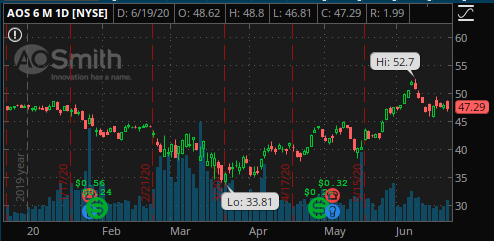

In case you missed it, the market shot up almost 5% last week. With this big move, I had some shares of SPY called away on Friday (short call against long stock). This week we discuss a few ways to get right back into the market to position ourselves to profit if the market continues to go higher. While the media often refers to the DOW (big numbers = big ratings?), we primarily invest in S&P 500 based indices (SPX options) and ETFs like SPY.

There are Lots of ways one can use options to express a bullish opinion. Here are some of the ones I use on a regular basis:

- Put Spreads

- Short Puts

- Risk Reversals

- Ratio spreads (Long 1 put, short 2 puts at a lower strike).

Put Spreads

Defined risk and reward, can often get a nice percentage return in a short period of time if the options expire worthless.

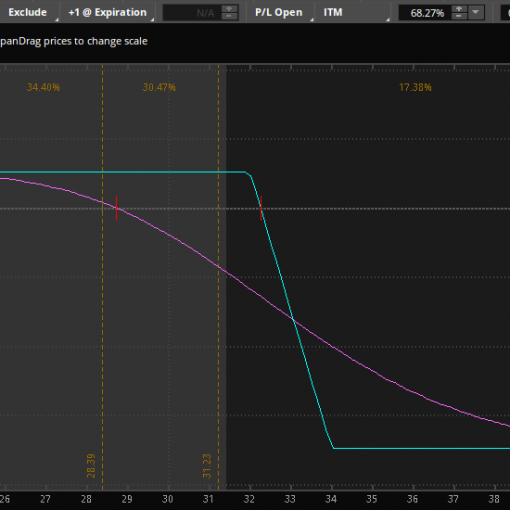

Short Puts

“Defined”, but high risk ($100 * the strike price minus the premium received) and reward. More premium than a spread at the same short strike. Often easier to roll for a credit particularly as IV often increases as the market drops

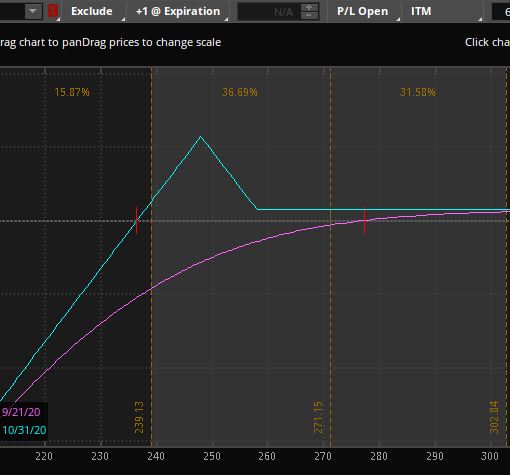

Risk Reversals

Short a put, long a call. Same risk as the short put, but with “unlimited” upside. Can be done for a credit, no cost, or a debit. I prefer a credit in case the underlying doesn’t move, I get a bit of a return.

Ratio Spreads

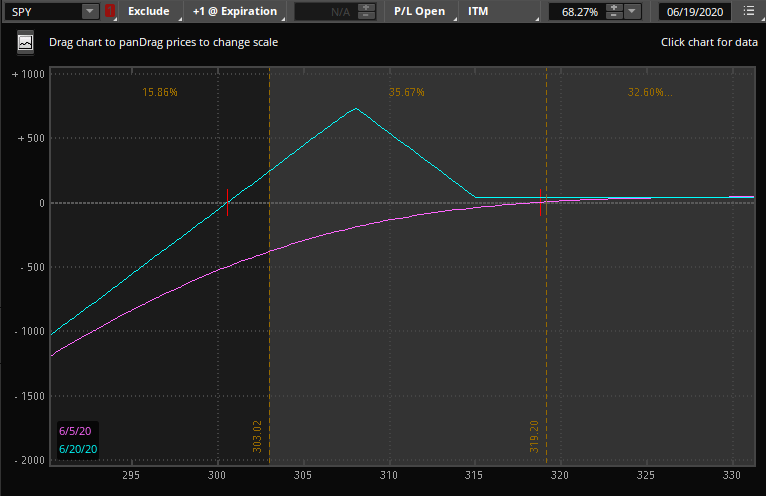

Can be done in plenty of different ways, but today we’ll use long 1 put and short 2 puts at a lower strike. Depending on how one sets this up, it can actually profit if “wrong” and the market goes down. This one is perhaps the least well known and a P&L diagram can help:

- Long 1 315 put, 19 Jun expiration

- Short 2 308 puts, 19 Jun expiration

- Credit of 0.40

Here are the possible outcomes:

- This spread will make $40 if SPY expires above 315.

- It will make more if it expires between 301 and 315 (Max of $740 Right at 308)

- It will break even at 300.60

- It will lose as if we were long stock below 300.60.

My portfolio is certainly weighted with bullish positions, so if the market continues to rally, I’ll do fine. If my portfolio was flat and I was bullish, I would look at the risk reversal. As an example, once can currently sell the 309 put and buy the 325 call for a 0.19 credit. Basically, the market would have to move down over $10 to be assigned, while our upside call is less than $6 above SPY’s current price (319.34 at close). This is due to the skew in options (a discussion for another day).

I have on the 1×2 that is listed above. With current market conditions, I like this a bit more than simply a short put at the 301 strike (which would take in about 1.20 in premium). The reason is that after such a big run-up, no one will be surprised if people start taking profits and the market pulls back some. If this occurs, we can potentially make a nice chunk on our position.

The P&L graph is setup to show the 1 standard deviation move that the market is pricing and you’ll see on the downside it lands close to 303, which would result in a profit close to $250.

If we look at the June 19th straddle, it is 10.30, which implies 309.04, which would be a profit of almost $640 at expiration.

As mentioned, I’m happy to take delivery of shares below 301 (well below where they were called away last Friday) and put these on only when they are cash secured.

The put 1×2 can be a nice trade when you are short term cautious, but long term bullish. You can experiment with different timeframes and strikes to really express your opinion on an underlying, while getting a bit of downside protection if you are wrong on your forecast. If you have questions, please reach out via email, Facebook, or Twitter.

Join Option Salary today for more trade ideas and education

3 thoughts on “Go long SPY at lower levels”