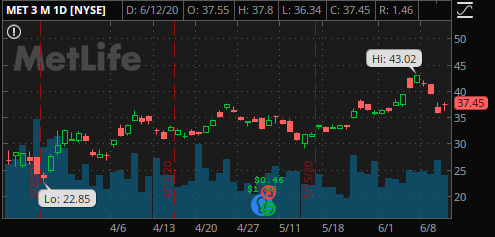

6/14/2020 Plan: This week we return to Metlife (Ticker: MET)

6/14/2020 Plan (continued):

- MET sell 17 Jul 30 put for 0.58

- If you prefer to spread due to IRA restrictions or for margin purposes, 30/27.5 for 0.23 x2

- Prices are as of market close 6/12/2020, actual fill and strikes may differ depending on Monday open, post will be updated accordingly.

- All trades are for educational purposes and do not constitute advice

- As always, reach out with any questions!

6/14/2020 Commentary:

We just took off our Metlife put last Monday and on Thursday the market had the biggest drop since March, taking MET with it. This has also driven up implied volatility, which means that we’ll get more premium for selling options. We were happy to take MET shares at 32 and would be even happier at 30! The same fundamental analysis still applies. This is a nice stock for a wheel and for those that can take the shares, the recommendation is to sell the put outright taking in more credit now. If assigned, we’ll sell calls to get out while collecting over 5% yield. The immediate return on risk for a 5 week hold would be $58/$2942 or 1.97%, or over 20% annualized. This is roughly the same as the last MET trade, the difference being that we’re at an even better entry point (30 vs 32).

Note if you want to go shorter term, the 30 put expiring 2 July is close to 0.32.

If you want more premium and are ok taking shares at 32.5, you can get 0.90 at the midpoint

As options traders, we can find opportunities in almost any market. The important thing is to see what the market is giving you. In this case, the market dipped, Implied Volatility has increased and we have a nice trade that could get us into a fine stock at attractive levels or we will gain a 2% return on our money in a bit more than a month!

Update- The original post referenced the 2 July put at 0.58. The correct price was mentioned later in the write-up at 0.32. The 17 July put was the one that was priced at 0.58. The rest of the commentary was correct.

6/15/2020 Entry: Sold 17 July 30 put for 0.72. The market started the day off significantly down and then made an impressive comeback. The put is only worth 0.52 at the end of the day for a quick $20 profit. One could take it off for a quick profit and move on to another trade or they can leave it on to collect more premium. This would be the equivalent of ~250% annualized return – completely unrealistic of course- but a nice win for a less than a day hold.

Personally I am still happy to take shares at 30 and will leave it on as I have sufficient cash to take assignment. At the entry of 0.72 we are now looking at a return of $72/$2928 or 2.5%, or closer to 26% annualized.

6/21/2020 Update: The put is worth 0.30 at the midpoint and we have an unrealized profit of 0.42 on the put. Already a nice win. Feel free to close and re-deploy capital or hold longer to capture more premium.

6/27/2020 Update: MET closed down on the week to just above 35. The put is still worth 0.30 at the mid point. Again, this has been a fine trade and one can close if they want to re-deploy the capital or take a bit of risk off the table as the market has been down.

7/5/2020 Update: MET stayed effectively flat for the week, this is a textbook example of theta decay as the option is now only work about 0.09. With another two weeks to go, I would recommend taking it off and re-allocating capital to additional trades. As with other put sales, if you really do want to add shares at the 30 strike, then you can leave it on.

7/6/2020 Close: Close MET puts for 0.05. A 0.67 ($67) gain in 3 weeks or 2.3% return on risk ($67/$2928) or an almost 40% annualized return. Excellent result with this trade and an easy one to manage -after the pop in the market on the 15th, this was never really in trouble.