8/16/2020 Plan: We look to sell a put in Slack (Ticker: WORK) again this week, to take advantage of the higher implied volatility.

8/16/2020 Plan (continued):

- WORK- Sell 1 of the 4 September 25 puts for 0.31. If it is available, may do the 24.5 put for 0.28

- We will not push 1 week as earnings are the week of the 11th.

- From a risk management perspective, if one still has the nearly worthless put in WORK that expires on 8/21, they should close it before opening this trade or recognize that they’ll have the additional exposure.

- Prices are as of market close 8/14/2020, actual fill and strikes may differ depending on Monday open, post will be updated accordingly.

- All trades are for educational purposes and do not constitute advice

- As always, reach out with any questions!

8/16/2020 Commentary:

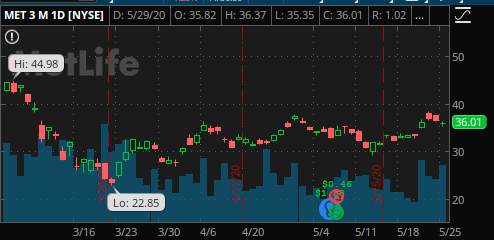

While COVID continues and many are still working from home, names like Slack should hold up reasonably well. It is a fairly volatile name, hitting a low of 15 in March and peaking at 40 just before earnings. Note how much higher implied volatility currently is vs. realized volatility. We look to take advantage of this buy selling options, in this case puts. This is a shorter term trade and the return is pretty decent, returning an immediate 1.25% if it expires worthless in ~3 weeks for over 20% annualized. Note the risk is based on WORK going to 0. If we are assigned, we’ll look to sell covered calls against the stock or potentially roll the put for a credit.

Reach out with any questions on this or any other trade!

8/17/2020 Entry:

Sold 4 Sept puts for 0.27. Good potential return for a bit under 3 weeks. Note that if you still have the WORK puts expiring this Friday, close for 0.04 to 0.05 or accept that you have greater exposure this week to underlying movement.

8/23/2020 Update:

The puts have started to decay nicely and are down to 0.18. No actions this week on this position – we’re about $4 out of the money with 2 weeks to go.

8/30/2020 Update:

Our 25 put is effectively worthless and can be closed for 0.01 or 0.02 at your convenience or simply let it expire. The risk in keeping it open is if Slack drops from ~32 to below 25, we’ll have to take ownership of the shares. This is a low probability event, but can happen – I will likely close the position Monday for 0.01

9/3/2020 Close:

Per the plan my open order to close the WORK puts was filled at 0.01. We gained 0.26 per put, another winning trade for those that took it.