Not too long ago, in addition to a poor joke or two, I suggested bullish option trades in Intel (Ticker: INTC) after it beat earnings and promptly sold off (a lot) on concerns over its struggles with 7 nm production. Flash forward one earnings cycle and the story is the same:

After last earnings cycle’s drop, Intel basically stabilized and then climbed back, recovering a portion of the post-earnings loss. We’ve again seen Intel meet or beat on its top line revenue as well as earnings per share. The Data Center Group did come up a bit short on expected revenue and some point to that as the reason for the significant decline. See all of the earnings details directly on Intel’s site.

Trade Ideas

With the stock now back at levels similar to last earnings release, here are a few bullish Intel option trades for playing a recovery in the name:

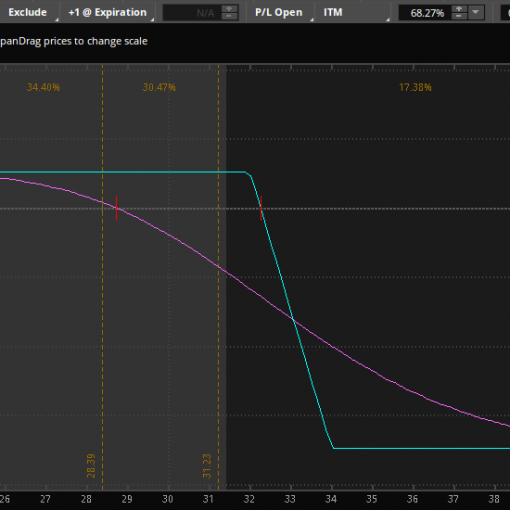

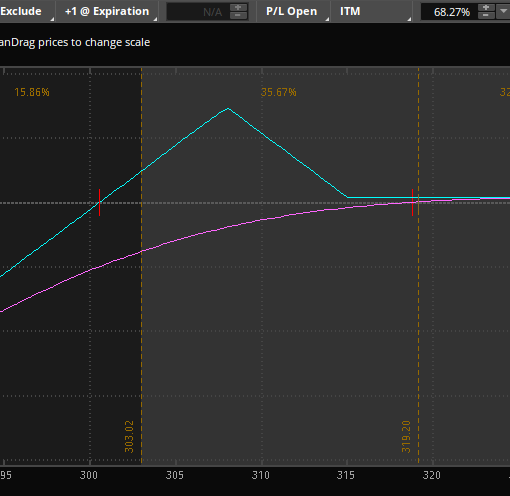

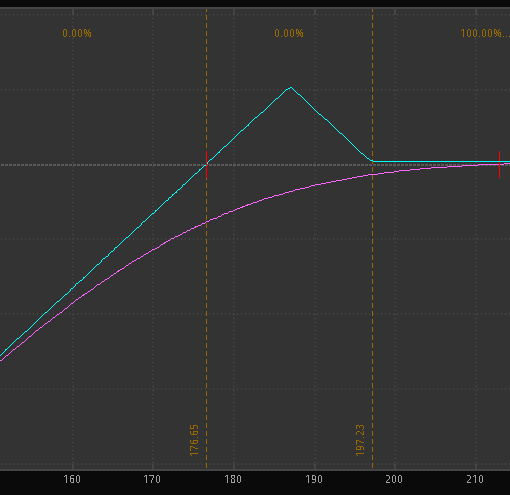

- 11/13/2020 expiration, sell the 45 put for 0.48 or

- 11/13/2020 expiration, sell the 45/40 put spread for 0.40 or

- Hold tight until after the election and re-evaluate

- Prices are at the midpoint as of 10/23/2020

- All trades are for educational purposes and do not constitute financial advice.

Selling the puts outright would result in owning shares at an equivalent of $44.52 if INTC ends below 45 on the 13th. The immediate return if the put expires worthless is 1.1% or almost 19.5% annualized as this is a 3 week trade.

The put spreads cap our downside risk in exchange for just 0.08 and also limits margin. If the spread expires worthless, it will be a return of 8.7% on the $460 risked per trade ($40/$460).

The 45 strike is outside of the expected move between now and November 13th.

What’s the downside?

Earnings Just occurred and there may be some lingering volatility in the name. Combined with the election, another approach is to simply wait a week and a half and then re-evaluate. Another approach is to put on half the size now and wait until after the election to put on the other half.

Margins are down at INTC vs. one year ago and AMD is a ‘flashier’ name. For put sales, I prefer the larger (INTC sells about 10x as much as AMD), slower moving INTC and its dividend in the near term, particularly now that it has gone “on sale”. I have and will continue to trade in and out of AMD [watch this space for more trade ideas!]

Intel’s valuation is well below its 5 year averages and it continues to grow revenue and profits. Now is (still) a reasonable time to try and pick up shares or at least profit from its currently depressed price.

Join Option Salary today and get trade ideas every week, with text alerts, personalized education, and more!