11/08/2020 Plan:

This week, we look at a few put sale ideas (and a put spread) in Activision Blizzard (Ticker: ATVI), Bank of America (Ticker: BAC), and Dow Inc (Ticker: DOW).

11/8/2020 Plan (continued):

- ATVI – Sell the November 20th 72.5 put for 0.5 or the 72 put for 0.46 (harder to fill) OR

- ATVI – Sell the November 20th 75/72.5 put spreads for 0.36 x2

- BAC – Sell the December 4th 22.5 put for 0.30

- DOW – Sell the November 27th 42.5 put for 0.37

- Prices are as of market close 11/06/2020, actual fill and strikes may differ depending on Monday’s open, post will be updated accordingly.

- All trades are for educational purposes and do not constitute advice

11/8/2020 Commentary:

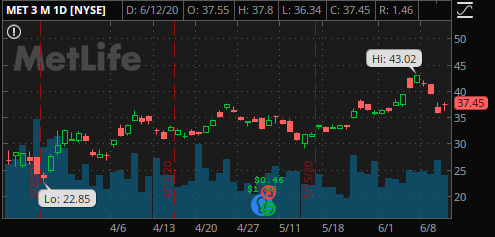

In case you missed it, there was an election last week. Despite it taking until the weekend to announce the winner, the market broadly rallied. Volatility reduced significantly, which you can see in the above charts.

As with past put sales, it is recommended that they are done cash secured and that you are willing to hold the stocks long term.

ATVI – for smaller accounts, definitely consider the spread it offers an almost 17% return and the risk exposure is low.

Both the BAC and DOW puts allow one to enter at much lower prices. One disadvantage to the BAC trade is that implied volatility is slightly under the recent volatility in the name. Depending on market conditions on Monday, I may pass on this trade.

Reach out with any questions on this or any other trade!

11/9/2020 Entry:

We sold the 74/71.5 put spreads for 0.36. Lower strikes than planned for the same credit. If you waited until later in the day, much better fills were available or you could have gone to even lower strikes.

11/15/2020 Update:

A wild week and a lot of stocks that did well during COVID sold off with the news from Pfizer. ATVI jumped around and ended up at 77.50 to end the week. Our put spreads are profitable, worth only 0.24 at this point. Expiration is this week, so take them off as soon as you’d like. I will likely be holding at least until Friday – but am also willing to take the shares and sell covered calls if needed.

11/22/2020 Update/Close:

The ATVI put spreads expired worthless this week. This brings in a full $36 per spread or $72 based on the sizing guidelines. This is a return of about 17% on our total risk. It has been a Great year for members – Reach out with any questions on this or any other trade!