I have friends that love going on cruises – so much that they prefer it over ‘standard’ vacations. I’ve never actually been on one, but I have invested and traded Carnival, which is the largest cruise line company in the world. The dividend has grown nicely the last few years and I’ve used the wheel a couple times. Haven’t decided whether it will be a long term holding or not (likely not).

The stock had a nice run up after earnings and has been pretty volatile. That has not been reflected in the IV – which was crushed after earnings and remained fairly low:

Notice how the historical volatility is well above the implied. While there is no guarantee this will always continue, the IV was so low, I put on a longer term straddle with the intent to take it off if the movement didn’t continue for a small loss.

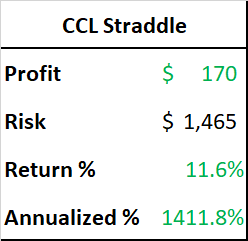

On January 14th, we placed 5 49.5 straddles with a 28 Feb 2020 expiration for $2.93 each. The target was $40/straddle or to take it off by the end of January or a $40/straddle loss if the stock simply sat.

The stock took off during the week and rather than face a long weekend (Holiday on 1/20/2020), we took off the position for a nice profit:

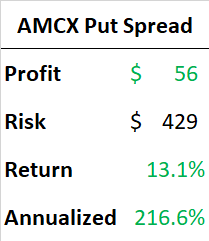

On 1/17/2020, We closed each straddle for $3.27 or a $0.34 profit. Total return for the position was 11.6% in just 3 days. A bit under our target, but also avoids any weekend risk and frankly it moved a lot faster than expected. Note also how implied volatility dropped after we put the position on, which was a drag on returns. While the stock remained volatile, a rising market often depresses IV.

Yes, the annualized return is ridiculous. No, we shouldn’t expect to ever get that.

While you can’t go on a cruise with the $170 in winnings, you can read the best essay that I’m aware of on the cruise industry. I highly recommend David Foster Wallace’s book of essays A Supposedly Fun Thing I’ll Never Do Again: Essays and Arguments. DFW isn’t the easiest to read, so feel free to pick up the Kindle version so you can look up words you don’t know.