5/3/2020 Plan: A wild week last week and the end result was the market was close to unchanged (down 0.2%)! Two very different trade ideas this week to consider. One will use most of our buying power and another is a rinse and repeat trade that closed this past Friday for full profit. I expect by the end of this post, I’ll add a third trade idea as well…

5/3/2020 Plan (continued):

- AAPL – 5 June expiration – buy 1 260 put, sell 2 250 puts for a credit of 2.10.

- We would be getting long AAPL shares at an equivalent of 237.90 if AAPL stays below 250 at expiration. This is over 50 handles below its current price (289 to 237.9). This puts almost our entire notional account size “at risk”, but the chance of AAPL going bankrupt between now and June 5 approaches 0%. One can also turn this into a broken wing butterfly by purchasing a far OTM put for a small debit (example 200 put for about 0.35). Spreads are wide, so expect less of a credit on the fill.

- UBER – Sell the 8 May 32/34 call spread for 0.26 2x.

- Note – This is a riskier play as earnings are this week – only put on if you are willing to accept higher volatility. Not a ‘core’ trade. One could go another week out to allow for more management of the trade after earnings (rolling, for example).

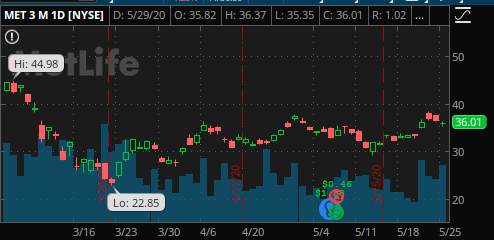

- C – Sell the 15 May 39.5/37.5 put spread for 0.25 2x. A third option for the week – straight forward put spread.

- Prices are as of market close 5/1/2020, actual fill and strikes may differ depending on Monday open, post will be updated accordingly.

- All trades are for educational purposes and do not constitute advice

5/4/2020 Entry:

- AAPL – Spreads tightened significantly. Given the longer term hold, went tighter with the spread to take in more credit as the more likely outcome is it expires worthless. Bought 1 260, sold 2 255 puts for a credit of 2.07. We’ll get in at an effective 247.93.

- Note that this position is already profitable (~$25). If one wanted to take a quick win and re-allocate capital they could. As a reminder, buying a far OTM put can simplify the margin on the trade and free up some capital if you don’t have portfolio margin. This is also an option to keep it a more straight forward trade vs. potentially taking delivery of the shares.

- UBER finished down ~$1 and much of the premium was already out of the spread. One Could put on the 32/34 call spread for 0.26 or 0.27 for the 15th of May, but this is quite a bit less premium than expected.

- C sold the 15 May 39.5/37.5 for 0.25 as planned

- Contact us with any questions

5/6/2020 Exit:

- AAPL – Closed the spread for 1.03 today, taking in $104 in just 2 days vs. waiting another 30 days. This allows us to free up the capital for additional trades. Note that one can certainly maintain the trade and capture the additional $103 of profit at low risk.

5/10/2020 Update:

- C – This position was worth about 0.04 by the end of the week and can be taken off at any time

5/12/2020 Exit:

- C – closed spreads for 0.02 – 0.23 profit for each spread, 13% profit on $175 risk (per spread). Total profit of $46, a nice standard trade!

- Contact us with any questions