8/9/2020 Plan: We look to add a mid term put spread in McDonald’s (Ticker: MCD) for a nice credit 8/9/2020 Plan (continued): MCD – Sell 1 of the 18 September 190/185 put spreads for 0.74. The bid/ask spread is currently wide, but I’ll also look at the 4 September 190/185 […]

Silver-Trades

8/2/2020 Plan: This week, your choice of bullish plays in two of the major banks – JP Morgan (Ticker: JPM) and Citibank (Ticker: C) 8/2/2020 Plan (continued): JPM – Sell 1 of the 28 August 90/86 put spreads for 0.60 C – Sell 4 September 45 put for 0.69 or […]

7/26/2020 Plan: Last we we tried to sell puts (or put spreads) in Slack (Ticker: WORK). This week, we try again! 7/26/2020 Plan (continued): WORK – Sell 1 of the 21 August 25 puts for 0.34. You could spread with the 23 strike for 0.25. Prices are as of market […]

7/19/2020 Plan: Two ideas this week – both are bullish cash secured put spreads – feel free to pick one or the other based on your account size, or consider spreads. Slack (Ticker: WORK) and Prudential (Ticker: PRU) 7/19/2020 Plan (continued): WORK – Sell 1 of the 21 August 26 […]

7/12/2020 Plan: Two ideas this week – an ETF and a follow-up from a recent trade: – Energy Select Sector SPDR (Ticker: XLE) and Walgreens Boots Alliance (Ticker: WBA). 7/12/2020 Plan (continued): XLE – Sell 2 of the 14 August 31/29 put spread for 0.30 or if you want to […]

7/05/2020 Plan: Two ideas this week in two very different names – Seagate Technology PLC (Ticker: STX) and Hartford Financial Services Group Inc. (Ticker: HIG) 7/05/2020 Plan (continued): STX – Sell either the 17 Jul 45/42 put spread for 0.38 or 24 Jul 44/41 for 0.40 HIG – Sell 31 […]

6/28/2020 Plan: This week we look to sell a put spread in Walgreens Boots Alliance (Ticker: WBA) 6/28/2020 Plan (continued): WBA sell 17 Jul 37.5/35 put spread 2x for 0.32 Prices are as of market close 6/26/2020, actual fill and strikes may differ depending on Monday open, post will be […]

6/21/2020 Plan: This week we look to sell a put in Capital One Financial (Ticker: COF) 6/21/2020 Plan (continued): COF sell 10 Jul 55 put for 0.77 (at the midpoint, the bid is 0.64) Prices are as of market close 6/19/2020, actual fill and strikes may differ depending on Monday […]

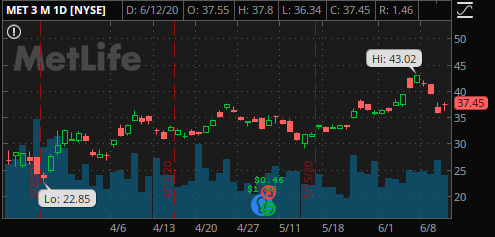

6/14/2020 Plan: This week we return to Metlife (Ticker: MET) 6/14/2020 Plan (continued): MET sell 17 Jul 30 put for 0.58 If you prefer to spread due to IRA restrictions or for margin purposes, 30/27.5 for 0.23 x2 Prices are as of market close 6/12/2020, actual fill and strikes may […]

6/7/2020 Plan: This week we look at a couple different ways to play Disney (Ticker: DIS) 6/5/2020 Plan (continued): DIS sell 26 Jun 115/113 put spread x2 for 0.30 or DIS buy 17 July 120/115 1×2 puts for 0.80 credit if you want to get long DIS at lower prices […]