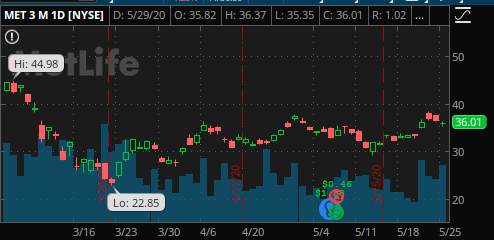

5/31/2020 Plan: This week we look at a neutral/bullish trade in Metlife (Ticker: MET) 5/31/2020 Plan (continued): MET sell 19 Jun 32 put for 0.38 If you prefer to spread due to IRA restrictions or for margin purposes, 32/30 for 0.20 x2 Prices are as of market close 5/29/2020, actual […]

Silver-Trades

5/24/2020 Plan: Two ideas to consider this week. As a reminder, US markets are closed in honor of Memorial day on 5/25/2020 and re-open on Tuesday, 5/26/2020. 5/24/2020 Plan (continued): WBA 19 Jun sell 36.5/35 put spreads for 0.29 x3. C – 12 Jun – sell the 40/38 put spread […]

5/17/2020 Plan: Two ideas to consider this week – one bearish positions and one bullish. Pick one or the other, or both! 5/17/2020 Plan (continued): AAPL – 5 Jun- Sell 330/335 call spread for a 0.47 credit. JPM – 5 Jun – sell the 78/75 put spread for a 0.51 […]

5/10/2020 Plan: We had a nice result with a recent WBA trade and this week we put on a very similar one: 5/10/2020 Plan (continued): WBA- 22 May – Sell 39/37 put spread for a credit close to 0.30, two times. For a bit more risk, there is the 39.5/37 […]

5/3/2020 Plan: A wild week last week and the end result was the market was close to unchanged (down 0.2%)! Two very different trade ideas this week to consider. One will use most of our buying power and another is a rinse and repeat trade that closed this past Friday […]

4/26/2020 Plan: Two trade ideas, one for more aggressive traders, one for more conservative. Volatility has continued to come down some as the market continues to grind higher. “Everyone” is expecting us to drop again, but the market has been resilient recently. 4/26/2020 Plan (continued): 4/27/2020 Entry: Unfortunately we did […]

4/19/2020 Plan: As strange as it seems, volatility has actually dropped over the last few weeks as we’ve had a nice multi-week move higher. Note, however, that volatility remains high on an absolute basis, with the VIX closing at 38.15 on Friday April 17th. This week, we look to sell […]

4/12/2020 Plan: Two trade options this week, one for longer term DIS bulls and another more risky play for those traders looking for a quick potential win. 4/12/2020 Plan (continued): DIS Bulls – sell the 1 May 80 put for 0.64 at the midpoint. This is a 0.8% return for […]

4/5/2020 Plan: With many US States restricting travel, Uber (Ticker: UBER) volume is way down. Their Uber Eats service is likely way up, but with fierce competition, they are losing money on every delivery. While I do enjoy using the service, I have been bearish on Uber and Lyft. With […]

3/29/2020 Plan: Volatility remains high with the market having multiple up days in a row last week. With much of the world staying home and many states ordered to do so, we plan a trade in Activision Blizzard (Ticker: ATVI), a name that should hold up well while more people […]