Can you trade options after hours? No. Rather than create the shortest article ever to a very commonly asked question, I’ll expand a bit since the full answer is a bit more complicated. This question is regularly asked, often during earnings season as traders are looking to close options after […]

Yearly Archives: 2020

11/01/2020 Plan: With the US Election this week, the low risk approach is to place no additional trades. For traders with a lower risk tolerance or smaller account size, that is this week’s recommendation. For those interested in placing trades, we look at a couple different “A” names – Activision […]

Not too long ago, in addition to a poor joke or two, I suggested bullish option trades in Intel (Ticker: INTC) after it beat earnings and promptly sold off (a lot) on concerns over its struggles with 7 nm production. Flash forward one earnings cycle and the story is the […]

10/25/2020 Plan: We return to Disney (Ticker: DIS) this week and also provide some additional trade ideas. 10/25/2020 Plan (continued): DIS – Sell the November 6th 120/117 put spread for 0.30. Prices are as of market close 10/23/2020, actual fill and strikes may differ depending on Monday’s open, post will […]

10/18/2020 Plan: We return to Johnson and Johnson (Ticker: JNJ) this week for a put spread idea along with a few other put sale ideas as back-up/additional trades 10/18/2020 Plan (continued): JNJ- Sell the November 13th 140/135 put spread for 0.61. Prices are as of market close 10/16/2020, actual fill […]

10/11/2020 Plan: We look at a put or put spread in Disney (Ticker: DIS) 10/11/2020 Plan (continued): DIS – Sell the October 23rd 120/116 put spread for 0.41. For those willing to hold DIS long term, sell the 119 put for 0.62 Prices are as of market close 10/09/2020, actual […]

10/04/2020 Plan: With a drop in Micron (Ticker: MU) last week, we look to sell a put spread in it. 10/04/2020 Plan (continued): MU – Sell 2 of the October 23rd 42.5/40 put spreads for 0.34. Prices are as of market close 10/02/2020, actual fill and strikes may differ depending […]

QQQ has returned over 28% this year (as of 9/25/2020). Just a few weeks ago, it was even higher topping 300. Made up primarily of “tech names”, it is well ahead of the other index-based ETFs as investors and traders bid up names that have done well in a pandemic. […]

9/27/2020 Plan: We look to sell a put in MetLife (Ticker: MET). Plus a bonus trade in INTC 9/27/2020 Plan (continued): MET – Sell 1 of the 23 October 32 puts for 0.38. Likely to get a lower fill here. A 33/31 spread for 0.25+ is another play for those […]

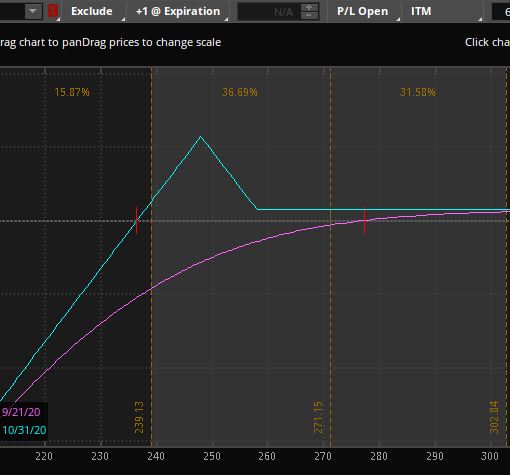

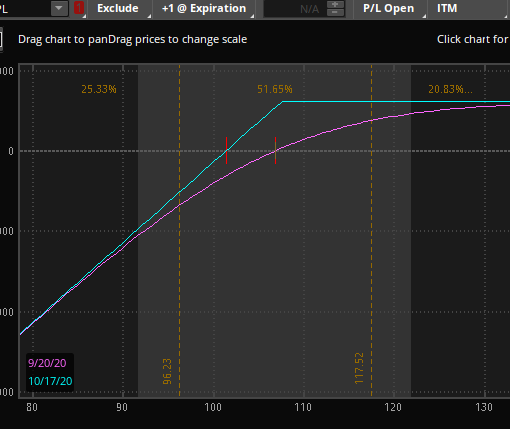

How well do you know your P&L charts? Good enough that you can quickly guess the underlying position(s)? Already know I’m trying to trick you because you paid attention last time I did this? Take a look at the below and guess what it is: Did you figure it out? […]