Betcha can’t eat just one. No really, don’t eat Intel’s chips. They are terrible. Worse than this joke. Back on July 23rd, Intel reported earnings. They beat Wall Street’s estimate by $0.12 ($1.23 vs. $1.11). They beat on revenue as well ($19.7B vs $18.55B). Earnings, revenue, net income, etc. all grew nicely from Q2 2020. Intel even provided full year guidance for 2020, again beating Wall Street’s estimates. As you’d expect when a stock beats on all fronts AND provides healthy guidance the stock took off …

That chart isn’t upside down, INTC dropped hard after earnings and then fell a bit more. This, by the way, is a great example of why I don’t place directional bets going into earnings!

With the stock suddenly a lot cheaper and it has stabilized a bit, we’ll look at a trade that assumes it doesn’t drop again in the near term:

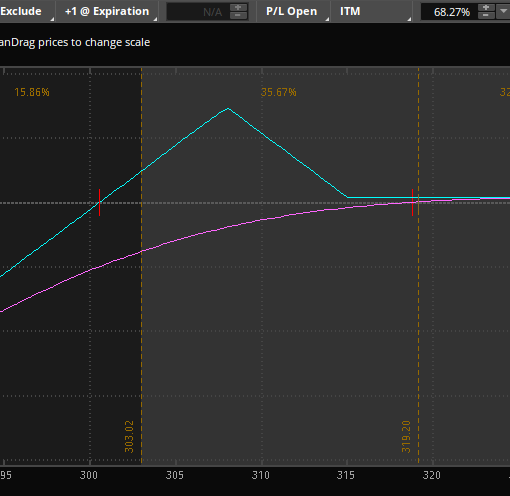

- 8/28/2020 expiration, sell the 47.5 put for 0.52 or

- 8/28/2020 expiration, sell the 47.5/45 put spread for 0.41 or

- 8/28/2020 expiration, sell the 46.5/45 put spread for 0.20

- Prices are at the midpoint as of 8/14/2020

- All trades are for educational purposes and do not constitute financial advice.

Selling the puts outright would result in owning shares at an equivalent of $46.98 if INTC ends below 47.50 on the 28th. The immediate return if the put expires worthless is 1.1% or almost 29% annualized as this is a 2 week trade.

The put spreads cap our downside risk in exchange for just 0.11. If the spread expires worthless, it will be a return of 19.6% on the $209 risked per trade ($41/$209).

To be very clear, this is not a low risk trade. The market is pricing in about a $2.3 move between now and the end of next week. The put and first put spread fall well into that range. If you sell the put, you should be prepared to take delivery of the shares. The strike is set below the low close on 7/31, but nothing says INTC can’t go below that value (just go back to March…). I’m OK with adding shares at this level and prefer the higher premium vs. selling a lower strike put.

For a higher probability put spread, one could look at the 46.5/45 put spread for 0.20. A lot less premium, but also less capital at risk, giving us a decent return if it expires worthless of 15.3% ($20/$130). The short strike of this spread is just outside of the expected move between now and expiration.

But what about AMD?

The beginning of this post includes the good news for INTC – the earnings highlight reel if you will. There are issues. Gross margin was down significantly from almost 60% to 53.3%. The other was the news that their latest chips would be delayed by about 6 months. Their main rival, AMD (Ticker: AMD) has already started selling 7-nanometer chips, which means they’ll have the market to themselves for even longer until INTC launches their chips. Have you ever considered the distance (‘pitch’) between adjacent transistors in a chip? If not, maybe this isn’t really as big deal. Also important, this news is priced into the stock now and there are no earnings or significant news expected on INTC during the duration of the trade.

AMD is taking market share from INTC and they have room to grow with less than 20% of the desktop share. Take a look at an AMD chart and you’ll see the market is encouraged as well. I think AMD is a bit extended currently, but I wouldn’t be surprised if I suggested trades in AMD in the future…

Intel’s valuation is well below its 5 year averages and it continues to grow revenue and profits. It will figure out 7nm and in the meantime, now is a reasonable time to try and pick up shares or at least profit from its currently depressed price.

Join Option Salary today and get trade ideas every week, with text alerts, personalized education, and more!

One thought on “Cheap chips”