Day before earnings – “XYZ reports tomorrow, I know it is going to beat expectations, and I’ve loaded up on calls!”

Day of earnings – “XYZ crushed it, but XYZ went down” or “XYZ crushed it, but my calls dropped in value”

I receive lots of questions and see plenty of posts about people trying to buy options going into earnings and are surprised when they get (guess) the earnings result correctly but the stock and/or options don’t cooperate.

The reality is, without inside information, we are guessing how a company will perform against the Expected earnings. Further, even if a company beats, but not by as much as the market wants, or there is less positive guidance, it may still go down (or not go up as much). Finally, “Everyone” knows that earnings are occurring and the options are priced accordingly, meaning you need a move more than the market expects to just break even.

This leads people to think they should simply sell options going into earnings. I’ve seen newer market participants recommend (or even worse, trade) short straddles to take advantage of the “IV Crush”. This Does work … until it doesn’t – and the trader then has a huge loss they may or may not be able to recover from.

As an example, let’s look at Zoom (Ticker: ZM) from their recent earnings on 8/31:

ZM was at about 305 at 9:45 Eastern on 8/31/2020. They reported earnings that night. Note that the IV was at about 82%, with historical at 59%. Since we “know” IV will be crushed, we sell a straddle – its worked in the past, so why wouldn’t it now?

The 305 straddle, expiring on 9/4 could be sold for $37.1 . As a reminder, a straddle is when you sell a put and call at the same strike. The seller in this case will take in $3710 of premium and as long as ZM doesn’t go outside the range of 267.9 to 342.1 we will make money!

Here is what ZM did:

You’ll see that ZM gapped up after earnings, well exceeding the straddle, causing a significant loss for those that chose to “take advantage of the IV crush”. The above was taken at about 3:45PM the next day.

That same 305 straddle that you sold for 37.1? It is now worth 153.07! It is worth more than 4x what you sold it for…

So, we can’t reliably Buy options going through earnings and we can’t reliably Sell options going into earnings, what can we do?

- Avoid earnings entirely. Snore. I know this isn’t exciting, but this is the easiest recommendation for newer traders (visit your local casino for equivalent excitement).

- Get out Before earnings. IV will remain elevated leading up to earnings and long options will decay less (they will still decay some). Buying options leading up to earnings, but not through earnings, can be a way to play movement a bit cheaper than normal.

- Put on risk defined trades, primarily spreads. Could be verticals, calendars, diagonals, butterflies, or even strangle straddle swaps…. Keep your position size in check and realize these will be higher variance plays.

- Use these quarterly opportunities to find potential bargains in names you want to hold long term.

Future columns may go into 2 and 3 in a bit more detail, upon request. Let’s talk about the 4th.

For those that are building long term stock portfolios, earnings offers 4 opportunities to buy stock at a discount through selling short puts. Let’s say you’ve been watching Slack (Ticker: WORK) for a while:

Back in March it hit a low of 15.1 and you missed the quick rebound back to 25 where it has been above since mid-April. You’d really like to add a couple hundred shares, but it had a drop last week (along with the rest of the market) and 29 seems a bit steep.

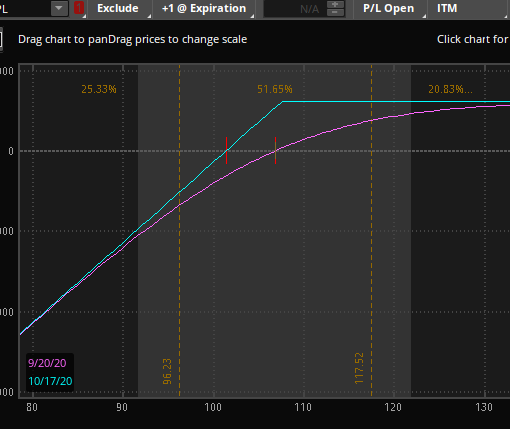

With Slack reporting earnings on 9/8, one can take advantage of the higher implied volatility from earnings (and the recent market decline) and sell 2 of the 25 puts for 0.46. If WORK drops below 25, you’ll pick up shares at an equivalent 24.54 more than 4.5 dollars off the current price – it is like a 15.6% off sale.

- Only put this type of trade on if you are truly comfortable taking the shares at 24.54.

- Prices are at the midpoint as of 9/4/2020 (for WORK)

- All of the above is for educational purposes only and does not constitute advice or a recommendation in any names referenced.

What happens if WORK explodes back up to $40? You’ll have made 1.9% in a week (about 97% annualized), which isn’t bad, but not as much if one had simply bought the shares. That is a trade-off with a short put. To minimize regret, one can buy some shares and sell some puts. In our example of wanting 200 shares, one could buy 100 shares and sell 1 put. This changes the risk/reward of course and if assigned, you’d own 200 shares at an average price of 26.81.

I don’t know any traders that make a consistent, long term profit buying or selling naked options around earnings. There are ways to play them and keep your risk manageable – and one can always simply avoid earnings to keep the variance in ones account down until they are more experienced.

Do you consistently sell (or buy) naked options for a profit into earnings? Just want to talk about options more? Reach out via email, Facebook, or Twitter.

How have we done this year in the fastest bear market and fastest recovery ever? Better than the market. Take a look at our results and then Join Option Salary today!