1/10/2021 Plan: This week we look at a few ideas, including a put sale (or put spread) in Nordstrom (Ticker: JWN): 1/10/2021 Plan (continued): JWN – Sell February 5th 26 put for 0.26 (may be hard to fill) OR JWN – sell the February 5th 29/26 put spread for 0.39 […]

Blog

All Option Salary Articles

Simply browse the below for articles of interest, filter on the categories above, or by using the built in search

Note – some articles are members only, join today for full access

2020 Year End Results – as many people are trying to quickly get past 2020, I’ll keep this as brief as possible (for me). 2020 Year End Results At Option Salary we provide real results, shared publicly with everyone here. Members have access to to the trades before they are […]

1/3/2021 Plan: Happy New Year!! This week, we take a look at variety of trade ideas – some put sales and some put spreads in CRM, HIG, GM, MET, and PFE. In 2020, we started the year primarily highlighting one trade per week. As the year progressed, based on member […]

12/27/2020 Plan: This week, we take a look at Facebook (Ticker: FB) and a couple bullish put spread options. We also look at a play on General Motors (Ticker: GM) 12/27/2020 Plan (continued): FB – Sell January 15th 245/240 put spread for 0.55 OR FB – Sell January 15th 250/245 […]

12/20/2020 Plan: This week, we return to Intel (Ticker: INTC) after it dropped significantly on Friday. 12/20/2020 Plan (continued): INTC – Sell January 8th 43.5 put for 0.34 OR INTC – Sell January 8th 44.5 put for 0.48 OR INTC – Sell January 15th 45/43 put spreads x2 (or 3) […]

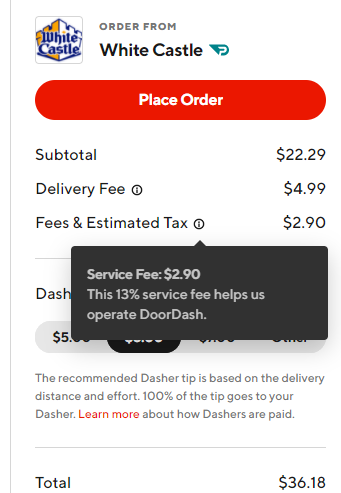

I’m bearish on DoorDash. I’ve been a user since before COVID, but really only when they offer a great deal – no delivery fee, $10 off, etc. During COVID, our family has used the service a bit more – but again, with promotions. They even offered a bonus $10 gift […]

12/13/2020 Plan: This week, we look at a bullish play in DOW (Ticker: DOW), a possible entry level for Microsoft (Ticker: MSFT), and a VERY speculative play in BYND 12/13/2020 Plan (continued): DOW – Sell January 15th 47.5 put for 0.58. MSFT – Sell the January 8th 200 put 2.0 […]

12/06/2020 Plan: This week, we look at a couple bullish ways to play Citigroup (Ticker: C) 12/6/2020 Plan (continued): C – Sell January 8th 52.5/50 put spreads for 0.29 2x C – Sell the January 15th 50 put for 0.63*** ALL – Sell the January 97.5/92.5 put spread for 0.62 […]

11/29/2020 Plan: This week, we look at two bullish plays in Intel (Ticker: INTC) 11/29/2020 Plan (continued): INTC – Sell the December 18th 45 put for 0.38 or INTC – Sell the December 18th 45/42.5 put spreads for 0.26 x2 DIS – Sell the December 11th 136 put for 0.72 […]

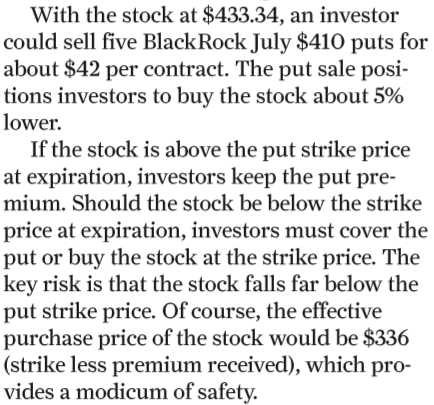

This is the fifth in an series of pointing out faulty options education, primarily in Barron’s. I’ve passed on a few in the last couple months, but these basic errors need a bit of public shaming with the hope that editorial quality will improve. What happened this time? The November […]