QQQ has returned over 28% this year (as of 9/25/2020). Just a few weeks ago, it was even higher topping 300. Made up primarily of “tech names”, it is well ahead of the other index-based ETFs as investors and traders bid up names that have done well in a pandemic. […]

Blog

All Option Salary Articles

Simply browse the below for articles of interest, filter on the categories above, or by using the built in search

Note – some articles are members only, join today for full access

9/27/2020 Plan: We look to sell a put in MetLife (Ticker: MET). Plus a bonus trade in INTC 9/27/2020 Plan (continued): MET – Sell 1 of the 23 October 32 puts for 0.38. Likely to get a lower fill here. A 33/31 spread for 0.25+ is another play for those […]

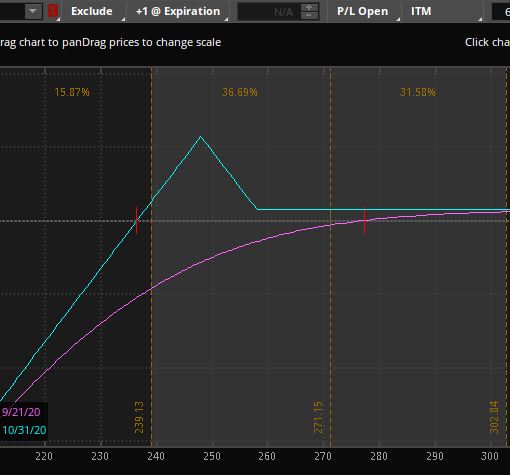

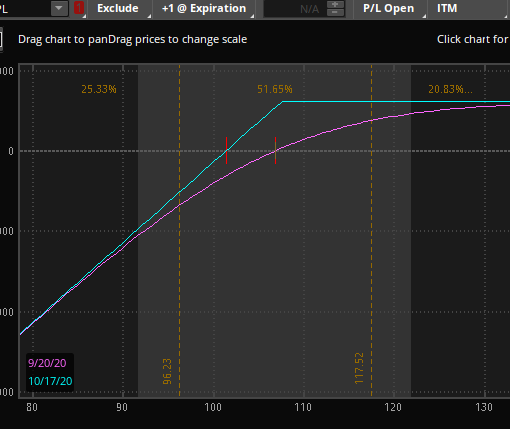

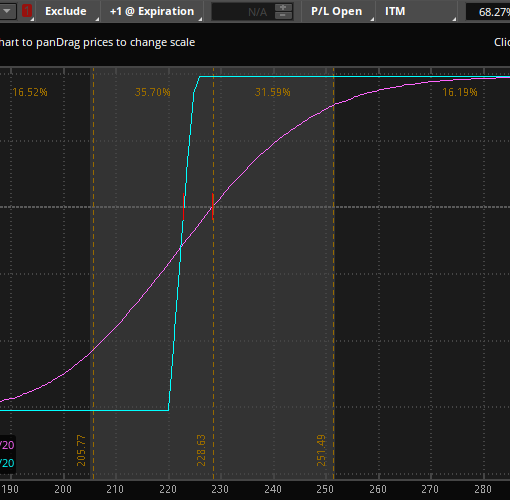

How well do you know your P&L charts? Good enough that you can quickly guess the underlying position(s)? Already know I’m trying to trick you because you paid attention last time I did this? Take a look at the below and guess what it is: Did you figure it out? […]

9/20/2020 Plan: We look to sell a put (or spread) in Slack (Ticker: WORK) 9/20/2020 Plan (continued): WORK – Sell 1 of the 2 October 23.5 puts for 0.32 OR the 22.5 put expiring 9 October for 0.28 WORK – Sell 2 of the 2 October 23.5/21.5 puts for 0.25 […]

I received a call from a member, a week before Apple’s split 4:1 asking whether they should buy shares for their long term account before the split or after the split. I gave my canned stock split pitch about how the value of the company is the same before and […]

9/13/2020 Plan: We look to sell a put spread in Micron (Ticker: MU) 9/13/2020 Plan (continued): MU- Sell 2 of the 25 Sept 42.5/40 put spreads for 0.28 Prices are as of market close 9/11/2020, actual fill and strikes may differ depending on Monday’s open, post will be updated accordingly. […]

Day before earnings – “XYZ reports tomorrow, I know it is going to beat expectations, and I’ve loaded up on calls!” Day of earnings – “XYZ crushed it, but XYZ went down” or “XYZ crushed it, but my calls dropped in value” I receive lots of questions and see plenty […]

9/7/2020 Plan: We look to sell a put (or a put spread) in Johnson and Johnson (Ticker: JNJ) 9/7/2020 Plan (continued): JNJ – Sell 1 of the 2 October 140 puts for 1.67 or the 140/135 put spread for 0.71 Prices are as of market close 9/4/2020, actual fill and […]

How well do you know your P&L charts? Good enough that you can quickly guess the underlying position? Take a look at the below and guess what it is (I’ll tell you later, try not to scroll and peek!): I know this isn’t really a hard one. Yes it is […]

8/30/2020 Plan: We look to sell a put spread in Intel (Ticker: INTC) or a put for those that want to own INTC long term. 8/30/2020 Plan (continued): INTC – Sell 2 of the 25 September 47/45 put spreads for 0.26. For a short put, sell the 47.5 outright for […]