6/28/2020 Plan: This week we look to sell a put spread in Walgreens Boots Alliance (Ticker: WBA) 6/28/2020 Plan (continued): WBA sell 17 Jul 37.5/35 put spread 2x for 0.32 Prices are as of market close 6/26/2020, actual fill and strikes may differ depending on Monday open, post will be […]

gold

6/21/2020 Plan: This week we look to sell a put in Capital One Financial (Ticker: COF) 6/21/2020 Plan (continued): COF sell 10 Jul 55 put for 0.77 (at the midpoint, the bid is 0.64) Prices are as of market close 6/19/2020, actual fill and strikes may differ depending on Monday […]

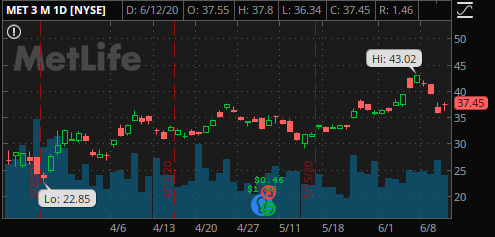

6/14/2020 Plan: This week we return to Metlife (Ticker: MET) 6/14/2020 Plan (continued): MET sell 17 Jul 30 put for 0.58 If you prefer to spread due to IRA restrictions or for margin purposes, 30/27.5 for 0.23 x2 Prices are as of market close 6/12/2020, actual fill and strikes may […]

6/7/2020 Plan: This week we look at a couple different ways to play Disney (Ticker: DIS) 6/5/2020 Plan (continued): DIS sell 26 Jun 115/113 put spread x2 for 0.30 or DIS buy 17 July 120/115 1×2 puts for 0.80 credit if you want to get long DIS at lower prices […]

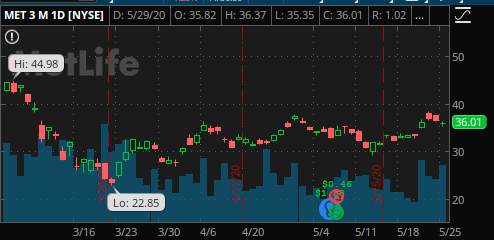

5/31/2020 Plan: This week we look at a neutral/bullish trade in Metlife (Ticker: MET) 5/31/2020 Plan (continued): MET sell 19 Jun 32 put for 0.38 If you prefer to spread due to IRA restrictions or for margin purposes, 32/30 for 0.20 x2 Prices are as of market close 5/29/2020, actual […]

5/24/2020 Plan: Two ideas to consider this week. As a reminder, US markets are closed in honor of Memorial day on 5/25/2020 and re-open on Tuesday, 5/26/2020. 5/24/2020 Plan (continued): WBA 19 Jun sell 36.5/35 put spreads for 0.29 x3. C – 12 Jun – sell the 40/38 put spread […]

5/17/2020 Plan: Two ideas to consider this week – one bearish positions and one bullish. Pick one or the other, or both! 5/17/2020 Plan (continued): AAPL – 5 Jun- Sell 330/335 call spread for a 0.47 credit. JPM – 5 Jun – sell the 78/75 put spread for a 0.51 […]

5/10/2020 Plan: We had a nice result with a recent WBA trade and this week we put on a very similar one: 5/10/2020 Plan (continued): WBA- 22 May – Sell 39/37 put spread for a credit close to 0.30, two times. For a bit more risk, there is the 39.5/37 […]

5/3/2020 Plan: A wild week last week and the end result was the market was close to unchanged (down 0.2%)! Two very different trade ideas this week to consider. One will use most of our buying power and another is a rinse and repeat trade that closed this past Friday […]

4/26/2020 Plan: Two trade ideas, one for more aggressive traders, one for more conservative. Volatility has continued to come down some as the market continues to grind higher. “Everyone” is expecting us to drop again, but the market has been resilient recently. 4/26/2020 Plan (continued): 4/27/2020 Entry: Unfortunately we did […]