A scan of my portfolio shows many trades that are short volatility/long theta. The trades benefit from little movement and time passing. This works really well – until it doesn’t. Rather than Always selling options, I prefer to have a variety of volatility hedges (VIX, SPX butterflies, etc.). I also […]

Monthly Archives: May 2020

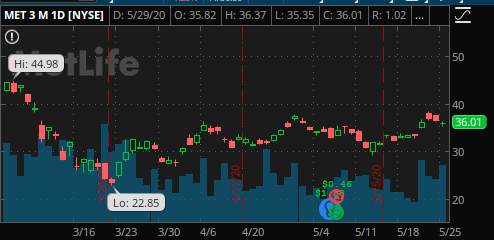

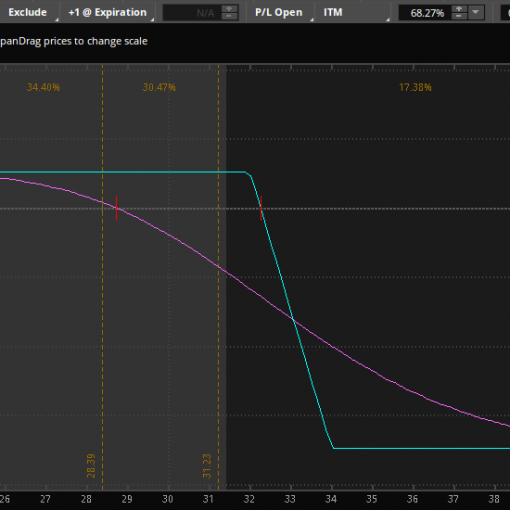

5/31/2020 Plan: This week we look at a neutral/bullish trade in Metlife (Ticker: MET) 5/31/2020 Plan (continued): MET sell 19 Jun 32 put for 0.38 If you prefer to spread due to IRA restrictions or for margin purposes, 32/30 for 0.20 x2 Prices are as of market close 5/29/2020, actual […]

I don’t actually have a Capital One (Ticker: COF) credit card in my wallet. I do have a debit card, though. I had my first online savings account with ING in the early 00s and Capital One bought them up back in 2011 for $9B. With this week’s trade, I’m […]

5/24/2020 Plan: Two ideas to consider this week. As a reminder, US markets are closed in honor of Memorial day on 5/25/2020 and re-open on Tuesday, 5/26/2020. 5/24/2020 Plan (continued): WBA 19 Jun sell 36.5/35 put spreads for 0.29 x3. C – 12 Jun – sell the 40/38 put spread […]

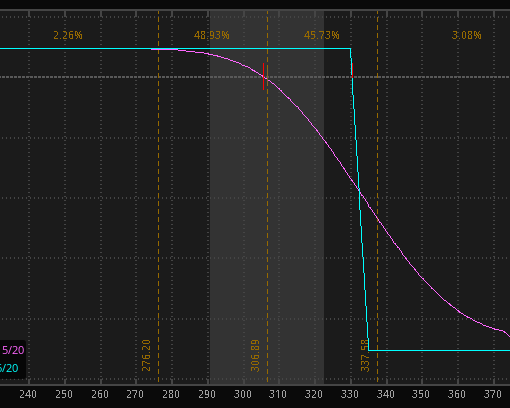

Simply put, betting against Apple is a bad idea. I’m going to recommend it anyway. 10 years ago Apple (Ticker: AAPL) was trading in the 30s. It is currently, as of 5/15/2020 above 300, up over 9 times while the broader market is up less than 3 times. Buying and […]

5/17/2020 Plan: Two ideas to consider this week – one bearish positions and one bullish. Pick one or the other, or both! 5/17/2020 Plan (continued): AAPL – 5 Jun- Sell 330/335 call spread for a 0.47 credit. JPM – 5 Jun – sell the 78/75 put spread for a 0.51 […]

5/10/2020 Plan: We had a nice result with a recent WBA trade and this week we put on a very similar one: 5/10/2020 Plan (continued): WBA- 22 May – Sell 39/37 put spread for a credit close to 0.30, two times. For a bit more risk, there is the 39.5/37 […]

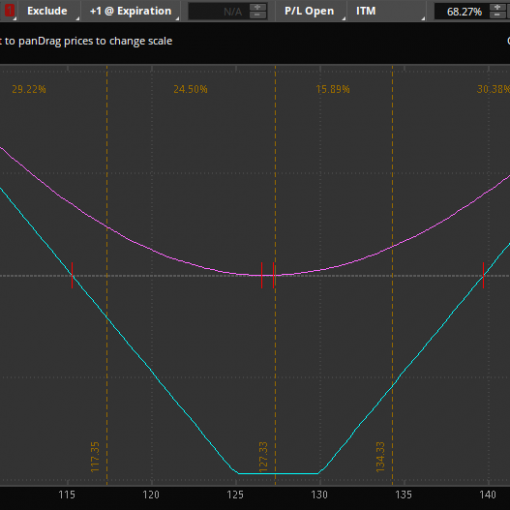

In case you missed it, the market has been volatile for the last couple of months. Snap-On (ticker: SNA), a high-end tool maker, has been moving around quite a bit as well as the three month chart shows: While the stock has come up a lot off its lows, it […]

I work full time. I have a wife, two kids, and a mortgage. I have enjoyed investing and trading for many years (decades now that I think about it!), but have always needed to find a way to do it part time. Today, I explore some of the advantages to […]

I’ve taken zero Uber rides since COVID-19 began. How many have you taken? Prior to the crisis, I’ve used the service quite a bit, especially when on business travel. It is convenient and links up nicely with my expense reports. The company loses a lot of money, so while the […]