This week we look at a bullish play in my favorite company in Idaho. No, not ADM Edible Bean Specialties (Ticker: ADM), but the maker of computer memory, Micron (Ticker: MU). Apologies for not making the obligatory potato joke. A 6 month chart shows that Micron has recovered much of […]

Blog

All Option Salary Articles

Simply browse the below for articles of interest, filter on the categories above, or by using the built in search

Note – some articles are members only, join today for full access

7/19/2020 Plan: Two ideas this week – both are bullish cash secured put spreads – feel free to pick one or the other based on your account size, or consider spreads. Slack (Ticker: WORK) and Prudential (Ticker: PRU) 7/19/2020 Plan (continued): WORK – Sell 1 of the 21 August 26 […]

Tech is hot this year. As of 7/10/2020, QQQ is up over 24% while the SPY is still down (a bit). This week, we cover a stock you’ve probably never heard of – Momo Inc. (Ticker: MOMO). Descriptions are generic, but essentially it is a social networking and entertainment platform […]

7/12/2020 Plan: Two ideas this week – an ETF and a follow-up from a recent trade: – Energy Select Sector SPDR (Ticker: XLE) and Walgreens Boots Alliance (Ticker: WBA). 7/12/2020 Plan (continued): XLE – Sell 2 of the 14 August 31/29 put spread for 0.30 or if you want to […]

I don’t win on 100% of my trades. You don’t either. That’s to be expected. You can Estimate the probability of a trade winning in a variety of ways, but it is only an estimate and it certainly isn’t 100%! Sometimes you even place a trade and you are perfectly […]

7/05/2020 Plan: Two ideas this week in two very different names – Seagate Technology PLC (Ticker: STX) and Hartford Financial Services Group Inc. (Ticker: HIG) 7/05/2020 Plan (continued): STX – Sell either the 17 Jul 45/42 put spread for 0.38 or 24 Jul 44/41 for 0.40 HIG – Sell 31 […]

6/28/2020 Plan: This week we look to sell a put spread in Walgreens Boots Alliance (Ticker: WBA) 6/28/2020 Plan (continued): WBA sell 17 Jul 37.5/35 put spread 2x for 0.32 Prices are as of market close 6/26/2020, actual fill and strikes may differ depending on Monday open, post will be […]

2020 has been an … interesting year so far, to say the least. In the last year, the market is up 2.29% and year to date the market is down 6.86% [SPX as of 6/26/2020]. These nominal returns hide the fact that we are in the midst of a global […]

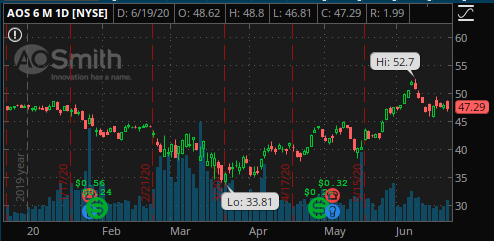

Let’s discuss a way to generate a bit of income on our long term stock holdings. This is a slight twist on the traditional covered call approach that I’ll be implementing on one of my underlyings in my long term portfolio. On Friday June 19th, I had some of my […]

6/21/2020 Plan: This week we look to sell a put in Capital One Financial (Ticker: COF) 6/21/2020 Plan (continued): COF sell 10 Jul 55 put for 0.77 (at the midpoint, the bid is 0.64) Prices are as of market close 6/19/2020, actual fill and strikes may differ depending on Monday […]